Blockchain technology, still in its infancy, is touted by supporters as the greatest technological innovation since the advent of the World Wide Web. Just as the internet revolutionized the way that information travels around the globe, blockchain, which some have taken to calling “Web 3.0,” could have a similar impact on the worlds of commerce and finance.

As a “distributed ledger” technology, blockchain creates an automated record of any transaction that multiple users can access without the need for middlemen such as banks, credit card companies or real estate title companies; deals that currently take days to settle can be completed in an instant. Virtually immune to hacking, blockchain also allows documents to be updated and amended without human errors sliding in.

While the breadth of potential applications remains vague, much as in the early days of the internet, one indication of blockchain’s growing clout is the nascent race among state governments to regulate the technology, to attract blockchain-based startups, and to adopt it for the delivery of public services.

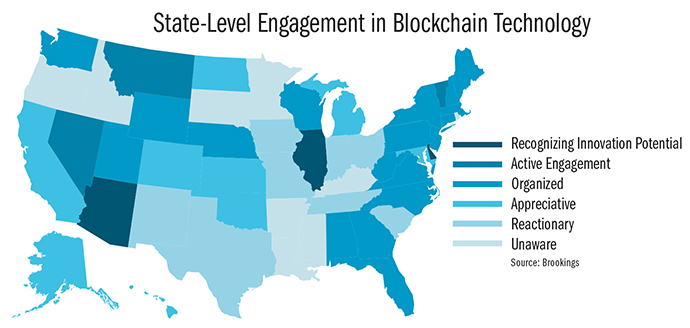

In a study in April, the Brookings Institution classified the states into six categories relative to their levels of engagement with blockchain technology (see graphic). Eight state governments were ranked as “unaware” of blockchain, having taken no action with respect to it. Eight were classified as “reactionary” for flagging blockchain-related cryptocurrencies as potentially risky. Seven “appreciative” states have made initial attempts to pass blockchain legislation. Seventeen states classified as “organized” have placed legislation on the books. Six “actively engaged” states have begun to apply blockchain to specific government functions; and four states “recognizing innovation potential” have introduced or passed regulations ranging from making blockchain contracts legally valid to allowing residents pay their income tax in cryptocurrencies.

“The level of appetite for blockchain reflects the states’ overall willingness to embrace emerging technologies,” says Kevin Desouza, one of the study’s co-authors. Desouza, professor of Business, Technology and Strategy at QUT Business School at Queensland (Australia) University of Technology, tells Site Selection that states resistant to blockchain may be influenced by “very rigid, dominant technologies where blockchain is a threat to disrupt everything.”

While the picture is rapidly evolving, the efforts of four states stand out:

Delaware

Widely regarded as the corporate capital of the United States, Delaware was the first state to the blockchain party, having launched the Delaware Blockchain Initiative (DBI) in 2016 and subsequently legalized the use of blockchain for issuing securities and maintaining state records.

As home to more than a million corporate entities, Delaware receives more than a quarter of its state revenue from its billion-dollar corporate franchise business, and has implemented plans to move much of that business to the blockchain. Officials believe the added security provided by blockchain technology will both bolster the state’s edge in corporate registrations and allow it to charge higher fees for filing processes, as blockchain automates much of what companies pay lawyers to handle.

In July, Delaware awarded a contract to IBM to design a prototype for a blockchain-based corporate filing system to determine how the technology can help Delaware-registered entities. As reported by the Delaware News Journal, Deputy Secretary of State Kristopher Knight compared the IBM project to building a model of a skyscraper before construction, saying that “it’s meant to show you that this is how we imagine these pieces working together. We’re talking about something that’s so new, and we don’t want anyone who’s bidding on this information to get it confused.”

Wyoming

Delaware is being challenged from a corner that might seem unlikely: Wyoming. In a bid to lure blockchain-oriented startups, Wyoming has enacted a series of laws that:

- Exempt blockchain startups from state taxes

- Allow for cryptocurrency trading

- Allow corporations to use blockchain technology to store company records

- Exempt virtual currencies from property taxes.

In addition, Wyoming lawmakers are considering legislation that would allow the creation of one or more “cryptocurrency banks,” with the goal of helping blockchain firms to operate in the state. The banks would provide financial services with blockchain-based assets.

Arizona

Arizona enhanced its reputation among blockchain-friendly states with the adoption of a law to allow corporations to hold and share data on a distributed ledger. The state also recognizes signatures recorded on blockchain as legal documents, meaning individuals can sign records or contracts on blockchain. In August, Arizona became the first state to launch a “regulatory sandbox,” allowing businesses across the fintech spectrum to test innovative financial products or services without first obtaining a state license.

Illinois

The Illinois Blockchain Initiative, launched in 2017, has spurred a series of pilot programs to determine ways to integrate blockchain technology and to lure blockchain startups. The pilots involve using blockchain to secure land title registries, validate academic credentials, register health providers, create a market for energy providers and secure vital records.

The Illinois Blockchain Task Force, composed of state lawmakers and agency representatives, released a 2018 report which found that “blockchain technology and its built-in encryption can facilitate highly-secure methods of interacting with government and keeping paperless records, increasing data accuracy and providing better cybersecurity protections for Illinois residents.”