nvite your uncle to pack his arc welder for a new life in Alberta.”

That June 2008 line from the Alberta Ministry of Employment and Labor’s Immigrant Nominee program pretty much sums up the province’s dynamic project activity and the frantic search for skilled labor that comes with it,

as Alberta repeats this year as the winner of Site Selection‘s Canadian Competitiveness Award.

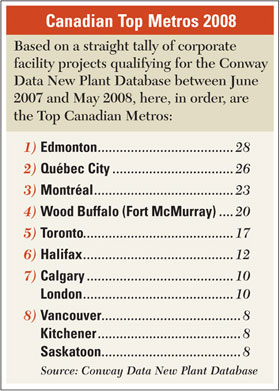

Based on a number of statistics and per capita calculations derived from Conway Data’s proprietary New Plant Database, which tracks facility location and expansion activity by private corporations involving new construction, the Competitiveness Award is based on project activity tracked between June 1, 2007 and May 31, 2008.

In this year’s ranking, New Brunswick came in second, and Québec barely beat out Ontario for third place among the nation’s 10 provinces.

With the common link of CN, new logistics project activity is popping up from the Port of Prince Rupert, B.C., to Edmonton’s “Upgrader Alley” to Guysborough, Nova Scotia, as multinationals look north for alternatives to crowded ports and congested rail lines and roads.

Sometimes, however, the obstacle is not congestion, but its absence.

Sometimes, in the rugged northern territories, the road simply comes to an end.

Enter a bold new venture from Boeing and Calgary’s own SkyHook International Inc., who plan to jointly develop an airship, the Jess Heavy Lifter or JHL-40, that will be ready by 2012 to lift and carry cargoes as heavy as 40 tons as far as 230 miles (370 km.).

In other words, no road will be necessary. The companies envision the aircraft moving shipping containers, utility towers, refinery and other heavy processing components, pipeline sections and firefighting slurry.

“Companies have suggested this new technology will enable them to modify their current operational strategy and begin working much sooner on projects that were thought to be 15 to 20 years away,” said the concept’s creator, Calgary native Peter Jess, in the July announcement.

Not only would the Jess Heavy Lifter help companies shrink their carbon footprints by eliminating energy expenditure on road construction, it would also help them navigate a shrinking window on the ice highways that serve those remote northern territories. Jess says they’re only available for 180 days a year, down from up to 250 days a year when he was plying his trade as a logistics expert in the oil industry.

The company plans to lease the airships via annual contracts, essentially operating an airline company. While the initial development work will occur at Boeing’s Rotorcraft Systems complex in Ridley Park, Pa., outside Philadelphia, Jess, a 30-year logistics and energy industry veteran, hopes to convince his partner that Alberta will be the place to make and maintain these unique vessels.

“We very much want to encourage Boeing to build an assembly facility right outside Calgary, located at a new aerospace park, which we would anchor,” says Jess in an interview

conducted on the heels of a European tour that included the Farnborough Air Show and the marriage of his eldest son, Matt, who also happens to be his vice president of operations. “That’s where we would carry out maintenance, training and R&D, as it pertains to all the equipment for under the hook – hoppers, tanks, racks and so on.”

He’s looking to Alberta and Canada for support. And the province is glad to oblige, as it looks beyond oil and gas to aerospace for future business development.

“They’re hoping for an Alberta solution, and we’d be keen to help them do that,” says David J. Peace, senior director, aerospace and defense, for Alberta Finance & Enterprise’s industry development branch and, like Jess, a trained helicopter pilot, just retired from the Canadian military. He says the future for airships is bright, as are other aerospace niches in the province, such as the testing and certification expertise clustered near the military operations near Cold Lake (in oilsands country) or the unmanned vehicle cluster that has developed over the years near Medicine Hat.

“Peter Jess’s opportunity is another area the province is interested in seeing develop,” he says. “It fixes so many problems up north. It’s amazing it hasn’t happened before.”

Jess says the market has been “sitting out there screaming for this” for 20 years, as the need to access remote locations for energy exploration grows. The proof is in the four-inch-high stack of interview requests, 700 e-mails and 400 phone calls that waited for him upon his return from Europe.

Jess says he simply identified components that already exist,

from Boeing’s rotor blades to “air envelopes” from American Blimp and ILC Dover. The added value from SkyHook comes in the form of the controls for the vessel, as well as the drive of Jess himself, who proclaims, “We are a commercial operation. We don’t want an R&D project.”

Jess worked radio operations, air traffic control and heavy equipment for oil companies operating in the Arctic in the 1970s. He flew in the high Arctic for four years, taking more engineering courses during the deepest winter. Soon he was looking after logistics on ice roads and ice airstrips. Then, 25 years ago, he started Jessco Logistics, focusing on support and services for everything from scientific expeditions to filmmaking in the high Arctic.

Though he’d had the airship idea for a long time, the approach of his 50th birthday prompted him to finally take action on it, beginning about seven years ago.

“We decided to sell most of our assets in the Arctic and put the money into conceptual engineering and stability analysis of the aircraft, to make sure I wasn’t breaking the laws of physics,” he says.

Eventually he got together with Boeing officials, who met him at a seminar, then returned to interview him, “checking to make sure I wasn’t part of the lunatic fringe,” says Jess. “They said they’d get back with me, and then called the next day, and said ‘When can you get to Philadelphia?'”

The partners decided it was viable in October 2007, and now a team of several dozen Boeing engineers is working in Ridley Park with Sergio de Paoli, SkyHook’s chief engineer, toward a critical development stage of the project late this year.

“Before Christmas, we’ll know exactly what this aircraft will look like and what it will be able to do,” says Jess.

Jess’s youngest son Ted will be working with Boeing pilots to be the first person trained from the ground up to fly the JHL-40. “We’ll find a lot of our pilots are going to come from among heavy crane operators and tugboat pilots,” says Jess, “people used to working with heavy loads and inertia.”

Oil and gas, mining, forestry and heavy construction are the target audience for the Jess Heavy Lifter. But he says more possibilities have arisen since the project announcement, all based on the simple premise of moving heavy loads over soft ground. Inquiries have come from the Middle East and from the jungle.

“It all boils down to one word – access,” he says.

A letter sits on his desk from a Chicago businessman who wants to lift three generators from an office building downtown and place them on a barge. Another builds skyscrapers, and wants to pre-build sections that he could then lift into place. Yet another opportunity is large chemical plants, which over the years acquire inertia all their own from incremental expansion.

“As it’s built, they keep adding to it,” Jess explains. “When components at the center of these plants need replacement, it often means building bridges and pipes to them, and they have to shut the plant down, which costs millions and millions of dollars.”

Lifting things in and out of place could solve that problem. At the same time, Jess’s company could help lift Alberta into true economic diversification.

In a nation of 33 million people stretching across so much magnificent land, one thing is consistent in economic development: Municipalities rarely feel they receive enough assistance from their provincial governments.

Over and above that universal truth, consistency in corporate project attraction (as tracked by Conway Data’s New Plant Database), job creation, regional partnership, proactive programming and quality data resources distinguishes Site Selection‘s Top Economic Development Groups of 2008, presented here in alphabetical order:

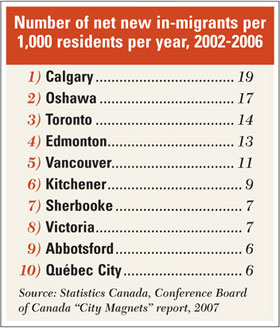

According to the Conference Board of Canada’s “City Magnets” report on attracting talent, Calgary’s per capita GDP in 2006 was 25 per cent greater than Toronto’s and more than 50 per cent higher than Montréal’s. “Stunning results in per capita income and employment growth underscore the prosperity boom in Calgary,” read the report.

The projects are keeping up with the people, including recent office expansions from Sure Northern Energy and Penn West Energy, and manufacturing projects from

HYDRA-Rig, Chemco Industries and Alberta Processing Co. Such corporate-owned projects are occurring against a backdrop of speculative building by developers, with some major leases in early 2008 coming from Iron Mountain, Coca-Cola and Anixter. Most dramatic among a work force skewing young is a continuing surge in both employment and job creation: In April, the city had the lowest unemployment rate of any city in Canada, at 3.1 percent, but still showed a 2.8-percent job creation rate since April 2007.

CED offers a wide array of programs, data and resources, from the CalgaryWorks work-force program to quarterly outlook reports and enterprise research. Best of all for site selectors, the data is as current as it is deep, and presented on an easy-to-navigate Web site that could serve as a best-practices example to any number of cities, provinces and, yes, countries.

In a province filled with its share of tri-city areas, the Technology Triangle partnership has been distinctive since its inception, marketing the region of Cambridge, Kitchener and Waterloo. Aided by broad institutional support that includes one of the nation’s most highly reputed universities (University of Waterloo), CTT does its part to both portray the region as it is, and push it toward what it could be.

In the same “City Magnets” report cited above, between 2002 and 2006, the Waterloo Region ranked fifth among the nation’s largest 27 metro areas in population growth, with Kitchener’s growth rate of 8.9 percent greatly outdistancing the national average of 5.4 percent.

Among the area’s recent projects was an expansion by national business icon Research in Motion (maker of the Blackberry) and a $75-million investment in a silicon refinery by Arise Technologies, both in Waterloo.

In Kitchener, landing gear component maker Heroux-Devtek is investing $28 million and hiring 50, while German firm Thomas Magnete is investing in Cambridge, home base for Toyota’s own expanding complex that includes the city of Woodstock.

Kent McMullin, director of investment attraction at Edmonton EDC, lists among the agency’s recent accomplishments the location of Sulzer Chemtech, with a $10-million, 100-employee operation; CV Technologies‘ $11-million headquarters and research complex; Epcor Utilities‘ new 28-story tower, which will see the addition of 200 employees to its payroll of 1,200; and a new corporate headquarters for sweetener manufacturer BioNeutra.

In Parkland County, part of the metro, growth included investments by Sysco Food Services ($70 million, 600 employees), National Fast Freight, Kal Tire and Tricycle Corp.

Helping its province solve a worker shortage, Edmonton EDC has held outreach events for students in Toronto, and held five forums to educate area business people on recruiting. The team’s “inreach” was good too: Among the 261 local companies the EDC visited in 2007, none signaled an intention to leave the region, 31 percent planned to expand facilities and 74 percent planned to expand employment.

The looming importance of the Port of Prince Rupert was reflected in a new Port Alberta initiative launched in January 2008, in partnership with other area organizations, to stamp the metro as a global logistics hub.

Now the organization stands poised as a crucial player in helping its area navigate the infrastructure, economic and social consequences of the flood of project activity now heading for “Upgrader Alley” on the city’s outskirts.

The year’s successes in Nova Scotia’s major port of entry for North America included a $44-million expansion by Oland Brewery and a two-phase aerospace manufacturing and R&D expansion by Pratt & Whitney.

Like many of this year’s winners, GHP is a public-private partnership. Among its strengths is the execution of enterprise research, such as recent reports on challenging myths surrounding growth, attracting young talent and cultivating even more of the metro’s thriving financial services sector. It also makes the effort to get out the news, via focused e-newsletters.

The fact that nearly every project during the period examined was an expansion of an existing business pays tribute to the partnership’s focus on relationship building. In the “City Magnets” report, the city ranked first in the nation in non-residential building permits issued between 2002 and 2006.

Among the strategies being pursued by the partnership are cultivation of creative sectors (building on the city’s university depth) and establishment of a larger logistics hub adjacent to the port. The latter achieved further reality in June, when the first phase of the new Atlantic Gateway-Halifax Logistics Park opened within the Burnside business park.

According to the Conference Board, London is expected to post economic growth this year of 3.6 per cent, sixth-highest in Canada and third-highest in Ontario.

Having the second-lowest labor costs among the country’s major metros won’t hinder that from occurring. Nor will the presence of the University of Western Ontario, which has contributed its share of commercialization successes.

Among the recent corporate expansions in the London metro are multi-phase projects from quartz surface maker Hanwha L&C Canada, CS Automotive Tubing and frozen dessert maker The Original Cakerie Ltd.

Among LEDC’s Web tools for site selectors are an updated taxes and incentives section and an updated work-force and education data, broken out by sub-category. A full report issued as a result of LEDC’s fall 2007 work-force survey is available at the agency’s newly established work-force Web site, www.londonworks.ca.

Though some soothsayers doubted Montreal’s industrial economy (and that of many other Canadian cities) could withstand the Canadian dollar’s parity with the U.S. dollar achieve in 2007, Montreal International has done its part to make sure it indeed could thrive.

Among a large number of manufacturing investments tracked during the period examined were pharmaceutical projects from Wyeth ($20 million) and Draxis Health, a $36-million packaging product investment from Induspac and a $20-million aerospace project from ExcelTech Aerospace.

Three areas attracting the agency’s focus in 2007 and 2008 include tax incentives for the new economy, measures for supporting R&D and attraction and retention of foreign strategic workers. A recent quality of life survey by Mercer Human Resources Consulting found Montreal in third place for all of North America – behind fellow Canadian cities Vancouver and Toronto.

Among this agency’s star assets is a data center that’s worth digging into.

Attention to talent infrastructure and the more basic variety keeps pace with the arrival of corporate projects to the Québec City area, where PÔle Québec is the chief economic development agency.

Recent projects have included a cluster of pharmaceutical expansions by such companies as BD Diagnostics, SFBC Anapharm and GlaxoSmithKline. At the same time, there are traditional manufacturing growth from glass maker AFG, wooden flooring maker Preverco, bus assembler Prevost Car and cheese producer Les Fromageries Bel. All of that corporate activity is supported by a host of new residential and office development, as well as institutional growth by area healthcare providers, the airport and Laval University.

That’s the school where the original technology being developed by BD Diagnostics originated, and where its original manufacturing facility still sits. Jamie Condie, vice president and general manager of BD Diagnostic’s Gene-Ohm division, told us Québec City rose to the top of BD’s site selection list because of its base of manufacturing and R&D talent, and the $2.8 million in incentives from the Québec government for the $39-million project.

The metro area has the lowest unemployment rate of any Québec city, having created more than 10,000 jobs between June 2007 and June 2008. Private construction and expansion projects are up 57 percent over last year. They include Valero Energy‘s Ultramar refinery and the Rabaska LNG project.

A relatively new partnership, this agency is an emblem of regionalism in a region overlapping with cooperative spirit, from this group’s individual member cities of Quinte West, Brighton and Belleville to the larger Ontario East economic development agency.

Highlighting the agency’s year was the announcement by Kellogg in early 2008 that it would open its first North American manufacturing plant in 20 years in Belleville, making a $98-million investment and hiring 100 new employees. The project will receive $9.7 million in incentives from Ontario.

Other companies growing in the Bay of Quinte region, halfway along the shoreline of between Toronto and the university town of Kingston, include Bioniche and ANR Foods. The food-processing sector is supported by tools such as a new training program offered by Loyalist College in Belleville.

Highlighting this agency’s work is a deep and navigable Web site that includes specific cost and site information and maps for site selectors.

Even without Shell going forward with a long-considered refinery expansion, Sarnia-Lambton’s economic momentum as a center of metals and energy expertise continues unabated, helped by the efforts of this partnership.

In St. Clair, Suncor Energy‘s ethanol plant will soon double production thanks to a $25-million grant from the federal government. Northern Ethanol is in the midst of its own $205-million, 50-employee project. And Lanxess is investing $68 million in a plastics expansion.

One significant partner for this area at the border crossing to Port Huron, Mich., is London’s University of Western Ontario, whose R&D park includes an 80-acre (32.4 hectare) campus in Sarnia-Lambton.

An indicator of the area’s balance – as it seeks to be known for clean technology at the same time it attracts industrial development – was its ranking exactly in the middle of environmental advocacy group the Pembina Institute’s Ontario Sustainability Index in 2007.

The Partnership makes a wealth of data available, including updated local tax rates and an effective suite of interactive mapping and site locator tools that will even show you where various businesses currently are located, by sector.

When Maple Leaf Foods opened its $30-million, 163,000-sq.-ft. distribution center in Saskatoon’s Marquis Industrial Zone in April 2008, it said one reason was its central location for reaching both coastal B.C. and northern Ontario.

But geography is just one reason the area has seen recent projects from such companies as Cameco Corp., Cargill, JNE Welding and Bayer Crop Science.

In December 2007, a report from CIBC World Markets identified Saskatoon as having the third most active economy in the nation, behind only Edmonton and Calgary.

A separate study by Statistics Canada reported that the area was second only to Edmonton in annual employment increase, at 5.6 percent. And this spring, the Conference Board of Canada said the area’s 2007 GDP growth was the fastest in all of western Canada.

A 2008 second-quarter report from SREDA itself spells it out plainly: “The number of building permits for new projects grew substantially in the second quarter of 2008, causing year-to-date non-residential construction totals to surpass those of the second quarter of 2007 by 40 percent,” driven by a 57-percent increase in industrial permits. Meanwhile, communities bordering Saskatoon saw a 196-percent increase in non-residential construction.

SREDA’s suite of programs, data and tools have helped breathe life into the breathtaking statistics, SREDA offers site searchers updated data according to the IEDC matrix, detailed explanations of local incentives, and all the reasons why it’s called No. 1 in cost competitiveness in Pacific and Midwest North America by the 2008 KPMG Competitive Alternatives study.

At press time, the exchange rate was CA $1 = US $0.94.

Site Selection Online – The magazine of Corporate Real Estate Strategy and Area Economic Development.

©2008 Conway Data, Inc. All rights reserved. SiteNet data is from many sources and not warranted to be accurate or current.