The federal Inflation Reduction Act is hitting home in the south-central U.S., where states known for big employers in the oil and gas industries are generating thousands of new jobs in clean energy manufacturing through projects supported by IRA subsidies and tax credits.

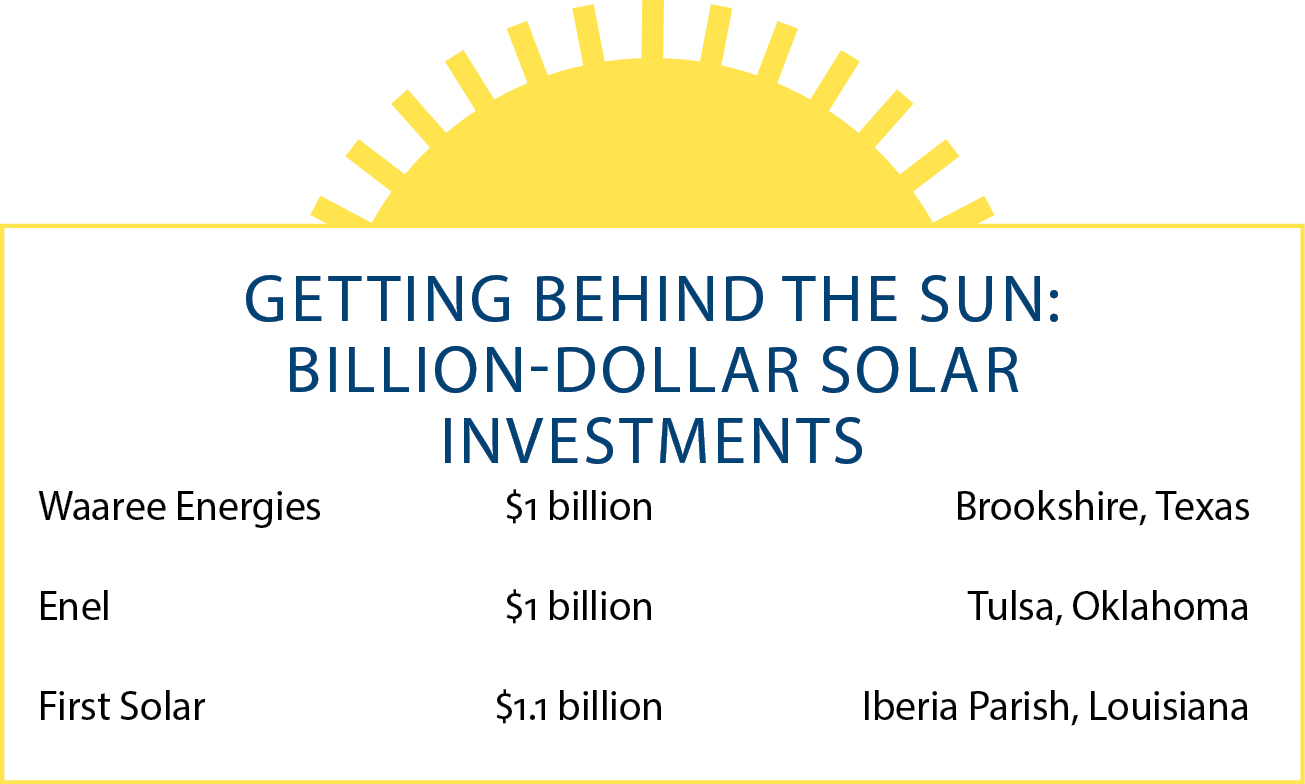

Here’s a look at some of the top investments and where they are going.

Texas: Four days before Christmas, India’s top solar panel maker announced that it would invest up to $1 billion to build a manufacturing plant near Houston. Waaree Energies projects an annual production capacity of 3 gigawatts when the facility opens later this year, growing to a massive 5 gigawatts through expansions to be completed by 2027. At full capacity, the plant — Waaree’s first outside India — is to support more than 1,500 jobs.

“Most major components used in the manufacturing of these solar modules will be sourced domestically, enabled in part by the Inflation Reduction Act,” said Sunil Rathi, interim CEO of Waaree Solar Americas. “We are committed to the U.S. and its growing demand for clean energy.”

Also in December, Changzhou, China-based Trina Solar held a preview event for its 1.35-million-sq.-ft. solar photovoltaic facility in Dallas County. Trina Solar, with U.S. headquarters in Silicon Valley, says it’s investing more than $200 million in property and equipment for the project, which is projected to create 1,500 local jobs. When completed this year, the facility will produce 5 gigawatts of solar modules with polysilicon from the U.S. and Europe.

“As someone who has lived in Texas for more than a decade, I’m proud to bring Trina’s first module factory in the Western Hemisphere to the Lone Star State,” said Steven Zhu, president of Trina Solar U.S.

Just north of Wilmer, where the Trina facility is going in, global powerhouse Canadian Solar is building a PV module manufacturing plant, its first in the U.S. The plant in Mesquite is joining a worldwide footprint that includes installations in Canada, China, Brazil, Thailand and Vietnam, soon to be joined by a recently announced facility in Jeffersonville, Indiana. The $250 million project in Texas is to create 1,500 jobs and produce some 20,000 high-power solar modules per day.

Tesla, which famously moved most business and manufacturing operations from California to Austin in 2021, recently announced plans to build what it calls the world’s largest rooftop solar installation at its Austin Gigafactory, the manufacturing hub for the company’s Model Y and its Cybertruck. The company says the roof will include 70,000 solar panels to power the 10-million-sq.-ft. factory with 30 megawatts of power. Earlier in 2023, Tesla announced plans to expand the plant with new investments totaling $776 million.

Oklahoma and Arkansas: As 2023 came to a close, EV maker Canoo delivered the first three of up to 1,000 delivery vans ordered by the State of Oklahoma and built at the startup’s new manufacturing plant in Oklahoma City. Gov. Kevin Stitt, who courted Canoo with a substantial incentives package, hailed the occasion as the first time in 17 years that vehicles had been produced in Oklahoma. Canoo recently moved its headquarters from California to Bentonville, Arkansas, and has pledged a 10-year, $321 million investment in Oklahoma that also covers a recently opened battery plant in Pryor, east of Tulsa.

Italy’s Enel announced plans in May to invest more than $1 billion in a solar cell and panel facility at Tulsa’s 2,500-acre Port of Inola. The factory’s expected annual production capacity of 3 gigawatts and its projected creation of 1,000 jobs could nearly double under a possible second phase. Oklahoma, according to an official connected to the recruitment, beat out prospective locations in at least two other states.

The Port of Inola was recently bolstered by a federal Build Back Better grant enabling construction of a wastewater treatment facility deemed crucial to drawing manufacturing investments like Enel’s.

“It’s one of the most sought-after requirements for all the major projects you see these days,” says Andrew Ralston, director of economic development for Tulsa Ports. “Every battery project, every hydrogen project, every solar panel project needs large capacities of wastewater and sewer water.” Giovanni Bertolini, president of Enel North America affiliate 3Sun USA, credited “the strength of the Tulsa Port of Inola site” as a location factor.

Louisiana: First Solar, based in Tempe, Arizona, broke ground in September on its $1.1 billion solar panel manufacturing plant in Iberia Parish, Louisiana. Billed as the company’s first fully integrated factory in the U.S., the Louisiana facility will join existing first solar manufacturing operations in Ohio and Alabama. Expected to launch production of PV panels in 2026, the project is expected to create more than 700 new jobs.

In December, First Solar announced the sale of some $700 million worth of tax credits earned under the IRA, the first such transaction of its kind in the solar industry. In a December 27 press release, the company said it struck two separate deals to sell $500 million and up to $200 million to Wisconsin-based Fiserv. First Solar said the credits result from the sale of solar modules produced in 2023 at its other U.S. locations.

“This is the IRA delivering on its intent, which is to incentivize high-value domestic manufacturing with the liquidity they need to reinvest in growth and innovation,” said Mark Widmar, First Solar CEO. “This agreement establishes an important precedent for the solar industry, confirming the marketability and value of Advanced Manufacturing Production tax credits.”

A Louisiana team of more than 50 stakeholders led by Louisiana State University early this year snagged more federal support as the NSF Engines program from the National Science Foundation selected Future Use of Energy in Louisiana (FUEL) to receive a grant that could amount to up to $160 million over the next 10 years. The focus is the transition and decarbonization of Louisiana’s industrial corridor, including opportunities in hydrogen and in carbon capture, transport and storage. The effort is backed by an additional $67.5 million from Louisiana Economic Development over the next decade. “This award builds on the foundation created by the GNO, Inc.-led H2theFuture initiative, which positioned Louisiana as the nation’s leading location for a hydrogen evolution, and a model destination for coalition building,” said Michael Hecht, president and CEO of Greater New Orleans, Inc.

Another LSU-led consortium, Gulf Louisiana Offshore Wind (GLOW) Propeller, was chosen as one of 31 national Tech Hubs by the U.S. Economic Development Administration.