Two actions within a week of one another in December spoke to how today’s energy surge in the United States and coming to terms with carbon emissions are converging to stymie one thing: coal.

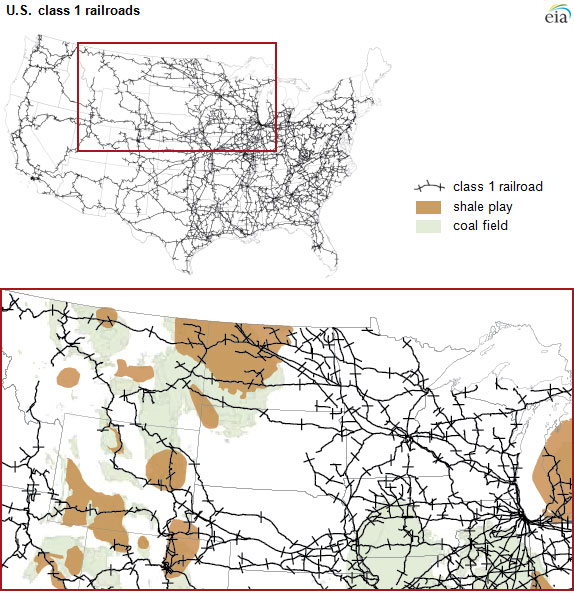

One was a FERC hearing to address rail congestion that has limited some utilities from maintaining the coal stockpiles they need, as well as limited some crop growers from moving their commodities. The use of rail fueled by the shale and oil surge in the US is at least partially to blame.

But that situation is relatively temporary, and showed signs of improvement by month’s end. Looming larger is the ongoing battle over carbon emissions policy.

Wyoming Gov. Matt Mead on Dec. 4 followed up on a complaint earlier in the year by filing a petition to participate as a party in the Oregon Office of Administrative Hearings for the Coyote Island Terminal coal port contested case. The Oregon Department of State Lands denied Coyote Island Terminal, LLC a permit to place standard concrete pilings in the Columbia River at the Port of Morrow, even after the state’s Dept. of Environmental Quality had approved three separate permits. That decision shut down the possibility of building a coal terminal.

The petition asserts Wyoming should be made a party to the contested case because it has significant interests in the outcome. Those interests include loss of revenue and jobs for the State of Wyoming and its citizens.

“This decision by the Oregon Department of Lands to deny the permit to complete this terminal is a barrier to getting Wyoming coal to foreign markets,” said Mead. “Wyoming would lose out on coal tax revenues of $9 [million] to $30 million per year. Revenue from coal funds public programs such as schools and infrastructure. A strong coal industry means thousands of direct and indirect jobs. Coal is vital here and Wyoming must assure it has a long future.”

EIA estimates that coal production for the first 11 months of 2014 was 909 million short tons (MMst), almost unchanged from the same period in 2013. EIA expects that annual production will grow by 1.2 percent in 2014 and remain flat in 2015.

Wyoming argues the State of Oregon cannot disrupt interstate and foreign commerce to the disadvantage of Wyoming and other landlocked states.

“The Commerce Clause of the United States Constitution prohibits Oregon from stopping the flow of a commodity in interstate and foreign commerce, and federal law preempts Oregon’s ability to regulate this kind of docking structure,” Mead said.

EIA projects electric power coal consumption of 868 MMst in 2014, an increase of 1.2 percent from last year. Power-sector coal consumption is projected to fall by 0.4 percent in 2015, as retirements of coal power plants rise in response to the implementation of the mercury and air toxics standards, and electricity and natural gas prices fall relative to coal prices.

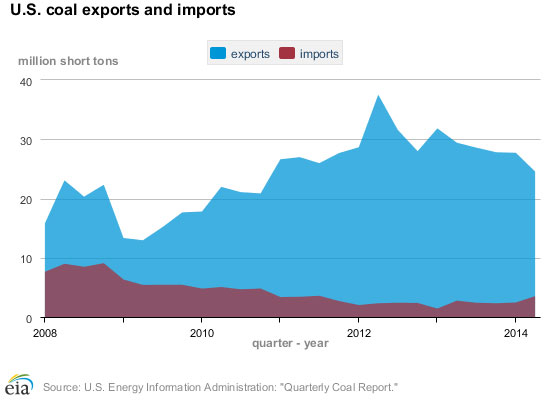

Compared to those volumes, export totals are a drop in the bucket, but significant nonetheless in terms of money-making opportunities. Exports of coal are projected to decline to 96 MMst in 2014 from 118 MMst in 2013, primarily because of slowing world coal demand growth, lower international coal prices, and increasing coal output in other coal-exporting countries. With no improvement in global market conditions, EIA projects coal exports to fall to 83 MMst in 2015, which would be the lowest since 2010.

Bay Area Coal Boom?

But that doesn’t mean low demand for pending export terminal projects.

According to JenAlyse Arena of the EIA’s Coal Statistics Team, the following list represents potential new ports for coal export that were in the planning and permitting process in December:

- Ambre & Arch Coal’s Millenium Bulk (Longview, Wash.)

- SSA Marine’s Gateway Pacific (Bellingham, Wash., aka Cherry Point)

- Morrow Pacific (aka Coyote Island) on the Columbia River in Oregon (potential capacity: 8 million tons)

- Armstrong Energy’s terminal in Plaquemines Parish in Louisiana (aka RAM Terminals LLC; Panamax vessels; potential capacity of 6 million tons)

The RAM project, however, was dealt its own blow this week in the usually energy-friendly state of Louisiana, when the Plaquemines Parish Council denied the terminal’s building permit.

“Two terminals in Houston have either plans to expand or have already expanded,” wrote Arena in December. “There is interest in building another terminal in Houston.” And a new Burnside Terminal on the lower Mississippi began operation in 2014.

As for existing coal export terminals, a review of the most recent EIA quarterly coal report reveals that customs districts showed decreases in coal exports, with Portland, Maine; Los Angeles, Calif.; Cleveland, Ohio; and Pembina, N.D., among those showing some growth. But the largest recent growth has occurred at the Port of San Francisco, where during the first six months of 2014 some 1.4 MMst left the dock, compared to 245,303 MMst during the comparable period in 2013.

That’s 472-percent growth. So much for West Coast solidarity. According to an October report by Bloomberg, in addition to Japan and China, much of that coal leaving San Francisco is bound for Mexico, where purchases of US coal rose by 17 percent during the first half of the year.

If the Bay Area can stomach it, then by golly, the Pacific Northwest ought to be able to as well, say supporters of the proposed terminals further up the coast.

“All three proposed NW coal export terminals have been designed to meet or surpass the region’s high standards for environmental stewardship”, said Kathryn Stenger, spokesperson for the Alliance for NW Jobs & Exports, in September when the Oregon permit was denied. “The recent approval of a two-year environmental assessment in British Columbia demonstrates that commodity terminals serving coal meet the high environmental standards our region expects. With Canadian and California ports expanding, Oregon and Washington risk missing out on the new jobs and investment these facilities would provide, and the benefits that investment brings to all trade-related industries.”

One of those Washington ports, the Gateway Pacific Terminal, would be located in Cherry Point, Wash., just south of the Canadian border, and would create more than 4,000 temporary construction jobs and roughly 1,000 permanent jobs once constructed. The site would also be one of the area’s biggest taxpayers, with over $4 million paid annually. The multi-commodity, dry bulk cargo-handling facility would be constructed on nearly 1,500 acres in Whatcom County, Washington, with development occurring on about one-quarter of the site.

The Millennium Bulk Terminal project in Cowlitz County, Wash., would revitalize a 70-year-old industrial site formerly home to an aluminum smelter build in 1941, would support 300 direct and indirect jobs once constructed, and would contribute up to $5.4 million in state and local taxes.

Still Glowing

In a statement accompanying an appeal by the Wyoming Attorney General in September, Gov. Mead said, “Coal is the fastest growing fuel source in the world.”

Is that the same world where coal-burning power plants are shutting down right and left? Could such a statement possibly be true?

In a word: Yes.

In a November statement, the World Coal Association said, “Calling for divestment from coal does not recognize the reality of growing energy demand,the continuing role of coal and the importance of technology in enabling coal use to be compatible with global efforts to reduce emissions. Coal has accounted for nearly half of the increase in global energy use over the past decade. In terms of energy, the 21st century so far has been built on coal. Coal’s global contribution alone this century is comparable to the contribution of nuclear + renewables + oil + natural gas combined.

“The latest figures from the BP Statistical Review of World Energy show that coal’s share of global primary energy consumption in 2013 reached 30.1 percent — the highest since 1970,” the WCA continued. “Coal was also the fastest growing fossil fuel, with coal consumption growing by 3 percent.”

In addition to providing essential, reliable baseload power for such energy-intensive industries as steelmaking, coal is also viewed by the WCA as a bridge out of energy poverty for many parts of the world, where 1.3 billion people don’t have electricity and 2.6 billion rely on wood or dung for cooking. The WCA uses China as the ultimate example: The People’s Republic has seen coal consumption grow by 400 percent in the past 35 years, and along the way has multiplied steel production by a factor of 18 and cement by a factor of nearly 14, while connecting 99 percent of its population to the grid.

The World Resources Institute reports that 1,199 coal-burning power plants representing more than 1.4 million megawatts (MW) are anticipated in 59 countries. And the International Energy Agency’s scenario for renewables and nuclear growth still sees coal consumption increasing by around 17 percent through 2035, driven in part by Asia, where coal’s forecast growth of 4.8 percent a year through 2035 comprises 30 percent of global growth in coal demand.

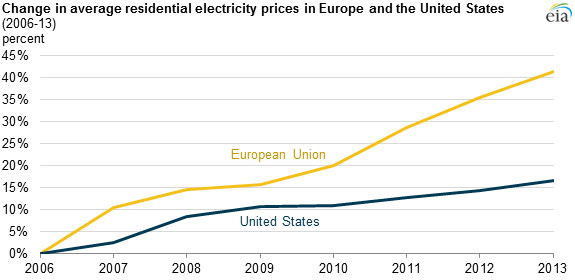

Jason Hayes, associate director of the 180-member American Coal Council, confirms the argument in favor of coal export terminals is driven by Asian demand. At the Council’s most recent conference, he says, speakers from major Korean and Japanese utilities “told us straight up ‘If you build those ports, we will use them.’ Over the past few years, we’ve had coal from PRB [Powder River Basin in Wyoming] mines going up into Canada and over to Prince Rupert to get out. That’s a pretty hefty hike to ship PRB coal — you’re paying more for the transportation than for the coal. It’s also going out through Vancouver when there are openings.” There also continues to be a steady stream of coal from East Coast ports to India and to Europe — contrary to the general impression that progressive European economies are practically carbon-free.

The dichotomy came to a head recently at the University of Glasgow in Scotland, which in October became the first UK university to take a stand by fully divesting from fossil-fuel companies, causing the reallocation over the next decade of approximately £18 million (US$27 million). An open letter from five engineering and science professors knowledgeable about energy markets castigated the school for its “vacuous posturing,” noting that alternatives aren’t yet to sufficient scale to substitute, and that the school had just started up a new gas-fired heating system because the preferred biomass alternative had a poorer environmental profile.

“We trust that those academic colleagues who voted for this gesture have had the moral consistency to turn off the heating in their offices (entirely fossil-fuelled),” the professors wrote, “and to switch off their computers and room lights for the 34.5 percent of the working day that fossil fuels provide electricity in Scotland.”

The latest omnibus spending package from the US Congress has something to say about coal use abroad. In late 2013, the Treasury Dept. stopped providing funds for conventional coal plants abroad, and shortly thereafter the Export-Import Bank — which provides financial support for projects that spur US exports — said it would restrict financing for most new coal-fired power plants abroad. Both were in keeping with President Obama’s 2013 call to only back fossil fuel projects abroad if they included carbon-capture technology.

The omnibus bill includes a rider that blocks the Export-Import Bank and the US’s Overseas Private Investment Corp. (OPIC) from using any funds to enforce such restrictions, stirring coal-country elected officials such as Rep. Hal Rogers (R-Ky.) to say this restriction of the restrictions would help “increase exports of US goods and services.”