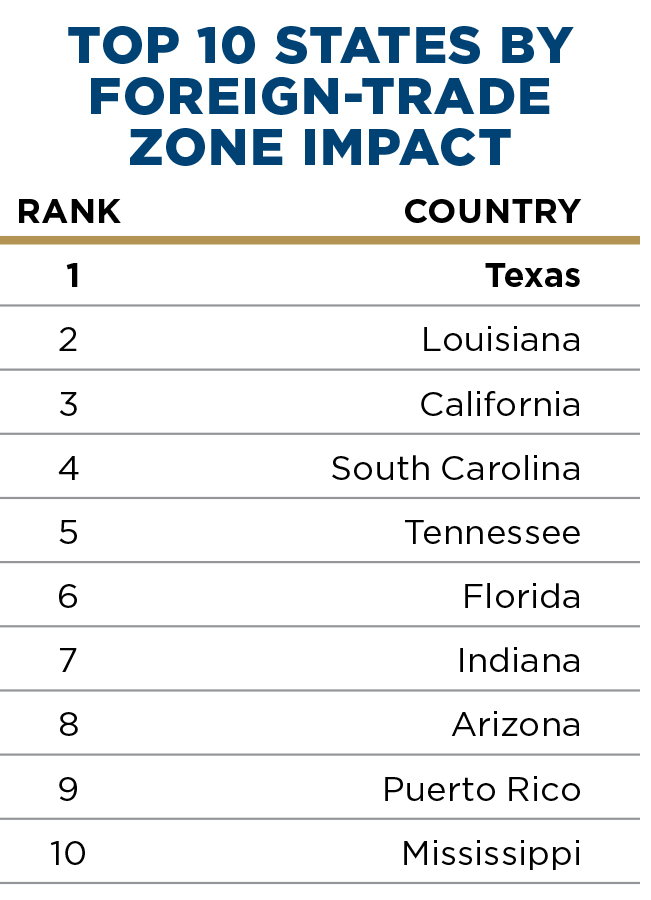

Based on an index using data sets from the 84th Annual Report of the Foreign-Trade Zones Board to the Congress of the United States, published in August 2023, Texas, Louisiana and California lead the nation in overall economic impact of federally designated Foreign-Trade Zones. South Carolina and Tennessee round out the top five.

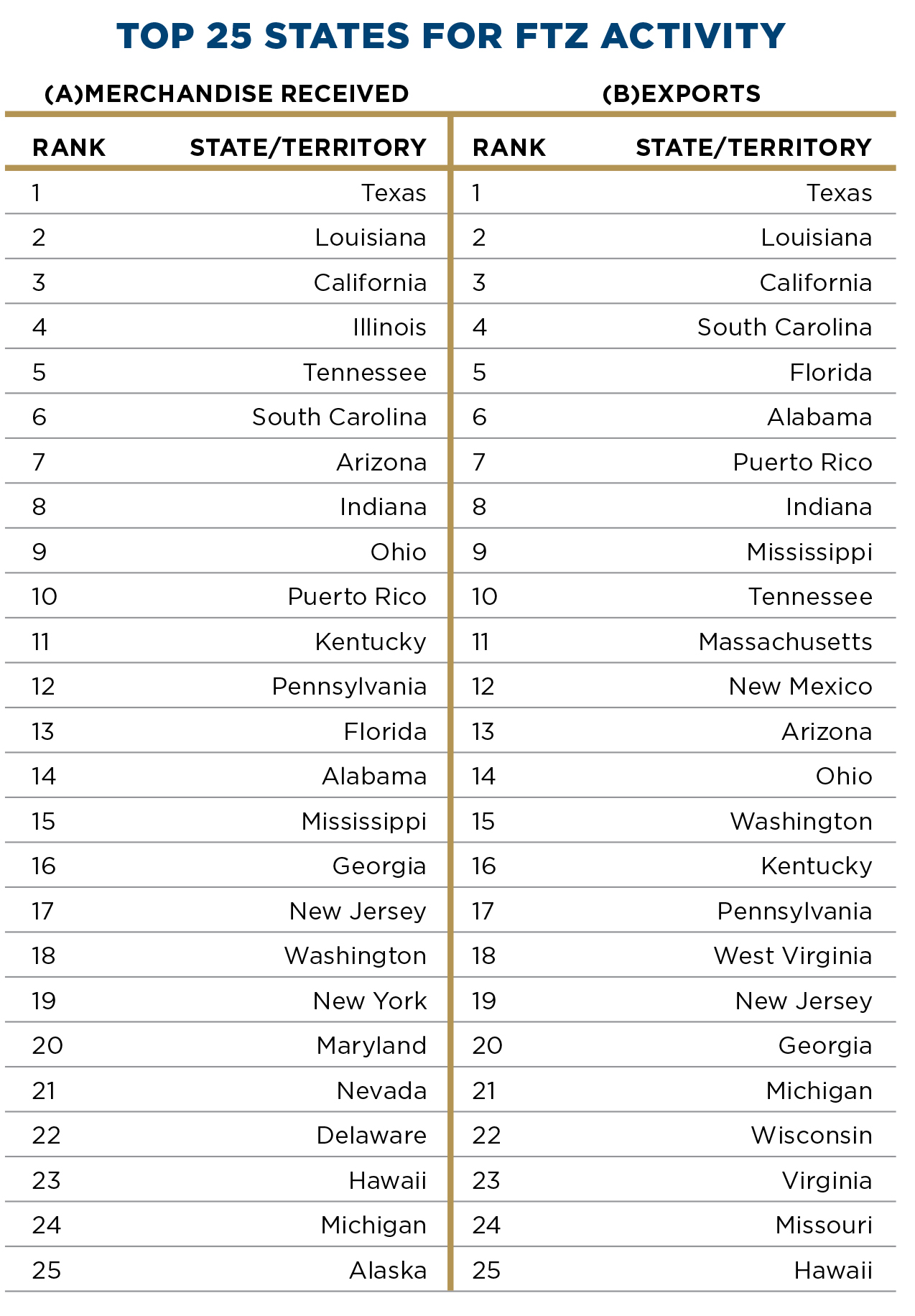

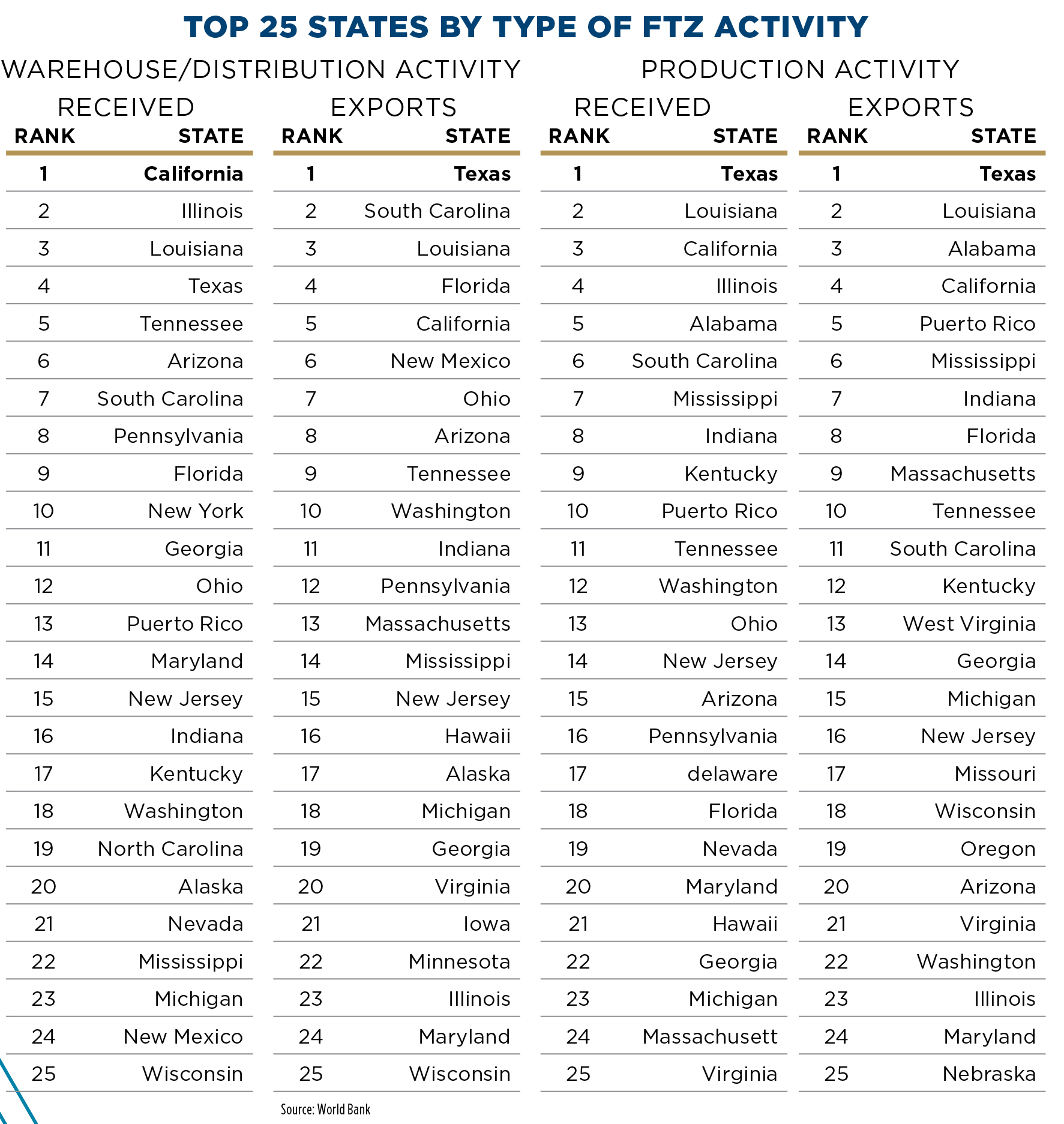

Using those same data sets — covering such areas as value of merchandise received, value of exports and number of employees in the zone — Site Selection also has compiled a list of the top 20 U.S. FTZs, topped by FTZ No. 18 in San Jose, California and FTZ No. 124 at the Port of South Louisiana. The next three are all in Texas, located in Houston (FTZ No. 84), Texas City (No. 199) and Port Arthur (No. 116), respectively.

Among the meaningful statistics in the report:

- There were 197 FTZs active during 2022, with a total of 361 active production operations.

- Over 500,000 persons were employed within 1,200 active FTZ operations during the year. The value of shipments into zones totaled over $1 trillion, compared with $835 billion the previous year).

- “The levels of domestic status merchandise used by FTZ operations — 79% for production operations and 48% for warehouse/distribution operations — indicate that FTZ activity tends to involve domestic operations that include significant domestic inputs alongside foreign inputs.”

- Warehouse/distribution operations received over $387 billion in merchandise while production operations received nearly $624 billion (62 percent of zone activity).

- The largest industries accounting for zone production activity include the pharmaceutical, oil refining, automotive, electronics and machinery/equipment sectors.

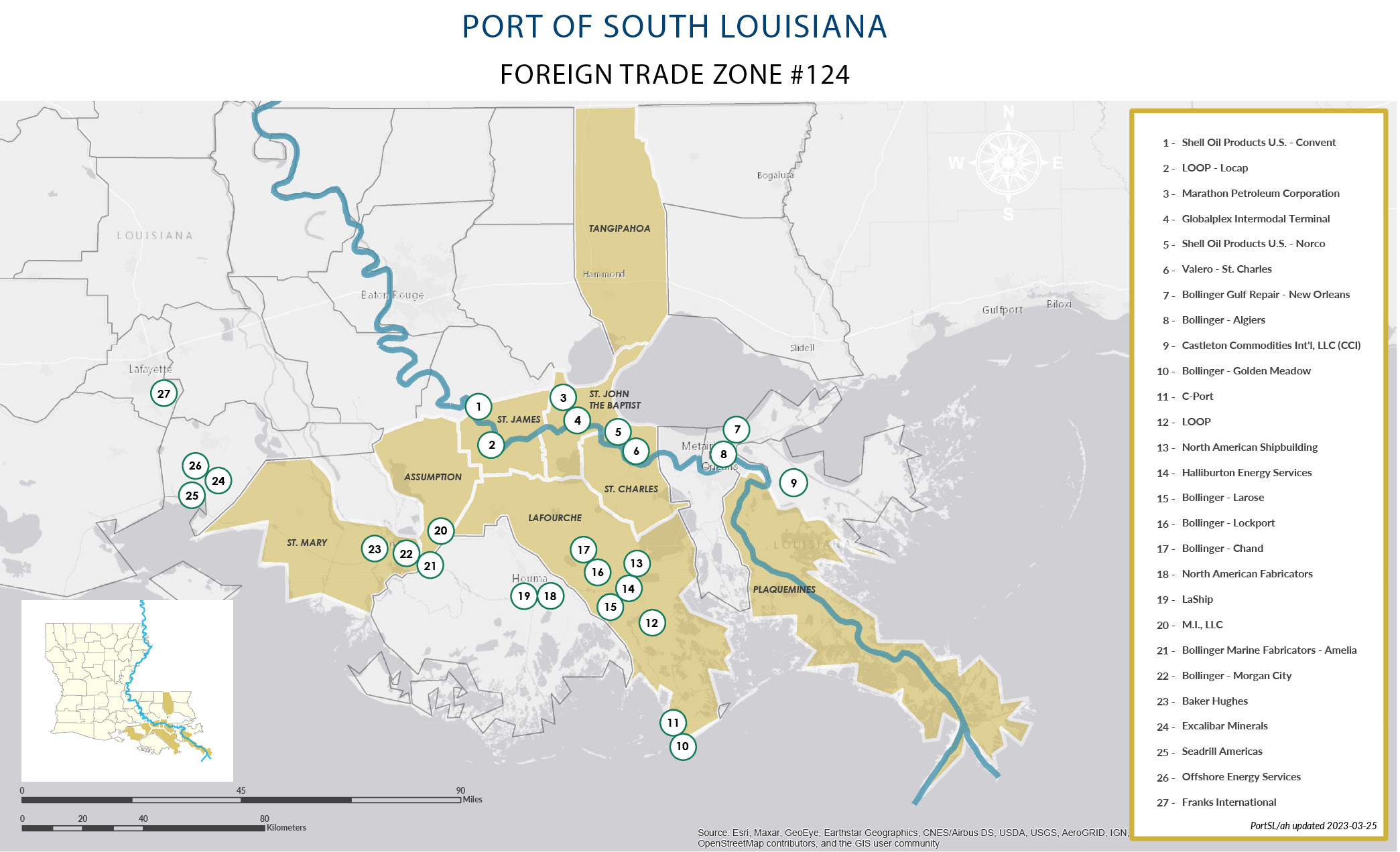

Map courtesy of Port of South Louisiana

Among the companies operating under the aegis of FTZ 18 in San Jose and Santa Clara County are Maxar Space, Lam Research, Tesla, RK Logistics Group, Bloom Energy, Enovix and Roambee Corporation. Maxar, which employs 4,600 worldwide, was acquired in May 2023 by U.S. private equity firm Advent International and minority investor British Columbia Investment Management Corp. for $6.4 billion.

In addition to a number of expansions in Texas and Michigan, RK Logistics recently opened new warehouses in Livermore and Hayward in the Bay Area. The Hayward facility is shared with Tesla and brings the company’s Bay Area portfolio to 12 facilities comprising 1.3 million sq. ft. In a February 2023 release, RK Logistics President Rock Magnan said his company operates the South Bay’s only certified, general purpose FTZ, calling it “a key asset to automotive manufacturing and the extensive import volumes it generates.”

The Port of South Louisiana (PortSL) is home to No. 2 FTZ 124. Its territory encompasses operations from some 27 companies, including seven grain transfer facilities, four major oil refineries, 11 petrochemical manufacturing facilities and several other facilities,

including the Executive Regional Airport. And the port is engaged in turning one shipbuilding site into a major logistics and commerce nexus, as the $330 million purchase by the port of the former Avondale Shipyard — now called the Avondale Global Gateway — was approved by port commissioners in August.

Image courtesy of NWTN

“In 2018, we had a vision for completely redefining Avondale Shipyards to create Avondale Global Gateway,” said HOST Chairman and CEO Adam Anderson. “Since then, we have turned a derelict site into a profitable center of commerce, created hundreds of jobs and secured tenants in our core industries of renewable energy, construction materials and sustainable food products. In partnership with the Port of South Louisiana, we are committed to reaching Avondale Global Gateway’s full potential and bringing even more sustainable business to the West Bank.”

“Avondale Global Gateway represents a transformational opportunity for the Port of South Louisiana and this entire region,” said PortSL CEO Paul Matthews. “We are experiencing dynamic shifts in global trade and logistics, and the acquisition of Avondale Global Gateway — while maintaining terminal management from HOST — presents an opportunity for PortSL to reinforce its position as a leading hub for commerce, not just in Louisiana, but along the entire Gulf Coast and around the world.”

If further proof were needed of this particular FTZ’s global impact, look to the fact that Over 60% of U.S. grain passes through PortSL, with exports of more than 48 million tons annually. A major port with a similar energy, petrochemical and grain profile is the Port of Odesa in Ukraine. So it was natural that the PortSL and the Ukraine Sea Ports Authority (USPA) signed an MOU in August launching a cooperative alliance “directed at technical guidance toward planning, development, construction, administration, and operation and maintenance of port infrastructure, particularly when reconstruction begins in Ukraine.”

“As two of the world’s leading grain exporters, the farmers and workers of the United States and Ukraine are tough and take pride in their role in feeding the world,” said Matthews.. “This agreement solidifies Port of South Louisiana’s support for the Ukrainian people in the defense of their freedom and creates an alliance with our Ukrainian port partners that focuses on our shared mission of serving global customers and creating economic prosperity for our communities.”

Over in Texas, Port Houston, home to FTZ 82, saw record volumes in 2022, with slight drops year-to-date in 2023 as of August. But that doesn’t signal cause for concern.

Photo courtesy of Port Houston

“After a record year in 2022, we were prepared to see a slight dip in import loads and export empty containers this year,” Roger Guenther, executive director at Port Houston, said in an August press release. “That said, we know the outlook is bright. The Texas economy is the eighth largest in the world and Port Houston is a vital gateway to millions of consumers. We are ensuring the fluidity of this gateway for the future by investing now in key infrastructure enhancements.”

Those include three new cranes and a new wharf at Bayport Container Terminal and the

Houston Ship Channel Expansion, known as Project 11, which by late 2024 should expand along more than 27 miles of the Galveston Bay area. “This critical project will benefit all who move cargo along the channel by increasing safety and efficiency, and it will help secure jobs in our region,” said Guenther.

The entire Houston Ship Channel complex supports 1.54 million jobs and $439 billion worth of economic activity in Texas — nearly 20% of the state’s GDP, says Port Houston.

Port Freeport — just outside the top 20 at No. 26 and one of six Texas ports in the top 30 — is home to operations from a plethora of energy, food, logistics, chemical and other companies, including Chiquita Fresh, Dole Fresh Fruit, Dow Chemical, ExxonMobil, Freeport LNG, Ford, GM, Tenaris and VW among many others. The port is No. 6 in the nation in chemical exports, No. 17 in total foreign waterborne tonnage and No. 26 in containers. A 2022 Economic Impact Study by Texas A&M Transportation Institute reported that the Freeport Harbor Channel “generates 266,300 jobs and has a total economic output of $157.3 billion.”

The port has kept up by going further down. A key improvement has been the recent deepening of that channel to 56 feet.

International Port Rankings Proxies for Zone Performance in Many Cases

As the USFTZ Board report explains, “Foreign-trade zones are secure areas under supervision of U.S. Customs and Border Protection (CBP) that are considered outside the customs territory of the United States for the purposes of duty payment. Located in or near customs ports of entry, they are the U.S. version of what are known internationally as free trade zones.”

If only those international zones had comparable data sets. But alas, despite decades of study, reports and clumps of random data, no global apple-to-apples data set exists on which a defensible ranking could be based.

There are proxies, however. One is the Container Port Performance Index (CPPI), produced by the Transport Global Practice of the World Bank in collaboration with the Global Intelligence & Analytics division of S&P Global Market Intelligence. Published this year, the latest CPPI finds China’s Yangshan Port in Zhejiang, Oman’s Port of Salalah and the UAE’s Khalifa Port atop the rankings, followed by Tanger-Med in Morocco and the Port of Cartagena in Colombia.

Photo courtesy of Tanger Med

“The Yangshan Deep-Water Port enjoyed the greatest year-over-year improvement in performance of the top ports in the CPPI,” said Turloch Mooney, director at S&P Global Market Intelligence, when the CPPI was released in May 2023. “Yangshan managed to reduce ship waiting time by a sizeable three hours per call in 2022 compared with 2021, and berth hours also improved over most call size ranges despite the challenging operating conditions in the first half of the year. Yangshan continues to build for the future with ongoing heavy investment in automation and rail connectivity.”

Among other regional findings the team announced in a press release:

- “Middle East and North Africa ports performed well again this year, with three ports from the region finishing in the top five: Port of Salalah in Oman ranked 2nd, Khalifa Port in Abu Dhabi took 3rd and Tanger Med ranked 4th.”

- “Ports in Latin America showed improved performance over 2022 with the Colombian Port of Cartagena taking 5th place overall and Ecuador’s Port of Posorja ranking 19th.”

- “In Southeast Asia, the Port of Tanjung Pelepas in Malaysia rose to 6th place this year, with Vietnam’s Cai Mep 12th and Singapore port 18th.” (See Tractus Asia’s analysis of Tanjung Pelepas vs. Vietnam’s Cai Cep — No. 12 in the CPPI — in the September 2023 issue of Site Selection.)

- “In 16th place, the Port of Algeciras in Spain is the highest ranked port in Europe.”

- “Wilmington, North Carolina (44th) and the Port of Virginia (52nd) are the top ranked ports in North America.”

Another proxy of sorts is the Xinhua-Baltic International Shipping Centre Development Index (ISCDI) Report, released in September, which ranked the Singapore No. 1 for the 10th year in a row. This report examines maritime centers and shipping services hubs more regionally, i.e. the “zones” evaluated might contain multiple variations of free trade zones or special economic zones within them. A total of 43 maritime locations were rated as part of this report, which “considers port factors including cargo throughput, number of cranes, length of container berths and port draught; number of players in professional maritime support businesses such as shipbroking, ship management, ship financing, insurance and law, as well as hull underwriting premiums; and general business environment factors such as customs tariffs, extent of electronic government services and logistics performance.”

“This was made possible by the strong support of our tripartite partners from the industry and unions,” said Singapore Acting Minister for Transport and Senior Minister of State for Finance Chee Hong Tat. “We will continue to grow our maritime industry to create more good jobs for our people, and make Singapore the global maritime hub of choice.”

Driven by its marine support services, London was No. 2, followed by Shanghai, Hong Kong and Dubai. (See this ranking’s top 10 chart and the top 25 ports in the CPPI to compare and contrast.) The overall trend was a familiar one: movement of the world’s power centers from Europe to Asia.

Here are a few highlights from ports and their affiliated zones featured in these global rankings:

Tanger Free Zone at the Tanger Med Port Complex in Morocco outside Tangier has grown to nearly 1,000 acres. Among the latest improvements to the site are two new ship-to-shore cranes at APM Terminals’ operation that part of the terminal’s third development phase.

The Port of Tanjung Pelepas (PTP), a joint venture between MMC Group (70%) and APM Terminals (30%), is Malaysia’s busiest transshipment hub with the capacity to handle 13 million TEU annually. The port in October set a new shift volume record with 13,700 quayside moves in a single 12-hour shift, breaking the previous record of 12,557 moves set in 2020. “PTP’s strategic approach to continuously enhance efficiency and optimize its footprint has served tremendously in keeping the terminal’s competitive advantage in an increasingly competitive global market,” said PTP CEO Marco Neelse.

Hamad Port in Qatar was for years referred to as the “New Port Project” as the country ramped up to hosting the World Cup in 2022. The port eventually will have three container terminals with a total capacity of more than 6 million containers annually. Key to the port’s development is Qatar Economic Zone 3 (QEZ3), which the port describes as “a self-contained development with industrial and residential facilities, will also be located adjacent to the New Port. As an essential element of Qatar’s development goals and objectives, the QEZ3 will be an important gateway into Qatar, providing an economic hub around the Port for manufacturing, logistics and trade across a number of industrial sectors and in turn fostering import and export synergy.”

The Transport and Logistics Bureau (TLB) in Hong Kong in April 2023 signed an MOU on Greater Bay maritime co-operation with the Guangzhou Port Authority (GPA) intended to strengthen collaboration through establishing a communication mechanism for maritime development; enhancing exchanges on youth and maritime talents in the Greater Bay Area (GBA); and actively promoting the maritime industry in the GBA. A release noted that the Hong Kong Port has been a transshipment hub in the region, “renowned for its high efficiency, strong connectivity and wide coverage, while the Guangzhou Port mainly handles domestic and foreign trade. This will enable a differential development of the ports in the two places on the principle of complementarity, collectively benefiting the manufacturing industry as well as the import and export trade in the GBA and southern China area.” The National 14th Five-Year Plan and the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area support Hong Kong in developing high-value-added maritime services so as to consolidate its position as an international maritime center.

Cai Mep International Terminal in Vietnam celebrated its No. 12 ranking in the CPPI in May by issuing a release in which Vietnam Deputy Minister of Transport Nguyen Xuan Sang said, “This is good news not only for Cai Mep and the maritime industry but also for Vietnam because Cai Mep’s role as a gateway port is particularly crucial for an export-oriented economy like Vietnam … The Ministry of Transport will continue to invest in infrastructure for Cai Mep and study additional policies to further develop Cai Mep as a gateway port and transshipment center for the Vietnam Southeast region, in line with the directive of the Politburo’s Resolution 24.” The terminal later in the year set its own new productivity record of 233 containers handled per hour, or nearly 7,000 TEUs in 20 hours, enabling the M/v Maersk Emden to depart three hours ahead of schedule. The port even cited the decades-old exhortation of former President Ho Chi Minh: “Therefore, the duty of the Vietnamese people, regardless of their profession — intellectuals, farmers, workers, traders, or soldiers — is to strive. Make it fast. Make it well. Make it more…”

APM Terminals Algeciras recently welcomed the MSC Loreto, a megaship with a capacity for more than 24,300 TEUs. The Port of Algeciras says it is one of only a few European ports able to handle this class of ship. It’s welcomed more than 1,000 of them since they began traveling the seas a decade ago. “Behind the scenes of these 1,000 calls to port, there was a public and private commitment over a decade ago to anticipate the future by fitting out our quays with draughts, fenders and cranes able to service megaships efficiently — this forward-looking investment has continued throughout the first half of 2023 with the recent introduction of new fenders on Juan Carlos I Quay,” the port announced.

King Abdullah Port, recognized as the most efficient port worldwide in the World Bank’s 2022 Report, recently welcomed back MSC Irina, the world’s joint-largest cargo ship with a capacity of 24,346 TEUs, after first welcoming it in May 2023. Jay New, CEO of King Abdullah Port, said, “The port’s success is reaching unprecedented heights, we are prioritizing infrastructure development, consistently investing in physical expansion to accommodate larger vessels, increase handling capacity and enhancing operational efficiency.” Once completed, the port will be equipped to handle 25 million TEU, 25 million tons of bulk cargo and 1.5 million CEUs (car equivalent units) annually according to the port’s master development plan.

Tianjin Port Development Holdings Limited in August announced it had handled 224 million metric tons through the first six months of 2023 with total container throughput of 10.27 million TEUs, 2.3% more than the same period in 2022. “The uncertainty of the global economy coupled with geopolitical and other factors have led to weakened external demand, which posed challenges to China’s port business,” the organization said. “Looking ahead to the second half of the year, the Group will continue to pursue high-quality development and prioritize customer needs; actively promote the advantages of the coordinated development of the Beijing-Tianjin-Hebei Region and fully leverage the role of the ‘maritime gateway’ hub of the Beijing-Tianjin-Hebei Region; continuously improve the level of port infrastructure, and promote the upgrading of port intelligence and low-carbon development; perpetually expand the functions of port services to maintain the smooth and efficient operation of the port; and strive to build a world-class, efficient, high-quality, smart and green port.”

Tianjin Port Development Holdings Limited in August announced it had handled 224 million metric tons through the first six months of 2023 with total container throughput of 10.27 million TEUs, 2.3% more than the same period in 2022. “The uncertainty of the global economy coupled with geopolitical and other factors have led to weakened external demand, which posed challenges to China’s port business,” the organization said. “Looking ahead to the second half of the year, the Group will continue to pursue high-quality development and prioritize customer needs; actively promote the advantages of the coordinated development of the Beijing-Tianjin-Hebei Region and fully leverage the role of the ‘maritime gateway’ hub of the Beijing-Tianjin-Hebei Region; continuously improve the level of port infrastructure, and promote the upgrading of port intelligence and low-carbon development; perpetually expand the functions of port services to maintain the smooth and efficient operation of the port; and strive to build a world-class, efficient, high-quality, smart and green port.”

UAE-based EV company NWTN’s plant in Abu Dhabi is its first EV assembly facility in UAE and is located in the Khalifa Economic Zone, ranked No. 3 in this year’s Container Port Performance Index. In July 2023, NWTN signed an MOU with the Abu Dhabi Department of Economic Development to enhance cooperation and contribute to the development of the automotive industry in the Emirate of Abu Dhabi. In September, NWTN signed an “All-weather Strategic Partnership Agreement” with Abu Dhabi Port Group, pursuant to which Abu Dhabi Port Group has agreed to assist and collaborate with NWTN in the areas of automotive production parts, complete built units, logistics on spare parts, local manufacturing of spare parts, shipments, customs clearance, financing for the upcoming project and vehicle distribution arrangement.