The Sunbelt states of the Southern U.S. remain the favorite business destinations for site selection consultants in 2024, but a few up-and-coming places may surprise you.

In the annual Site Selectors Survey, conducted in early December by Site Selection magazine, site consultants from around the country were asked 13 questions. We polled them on their favorite business climates, the biggest workforce challenges, the most critical location factors, rising countries for FDI, and other matters pertaining to corporate location intelligence.

Photo courtesy of charlottesgotalot.com

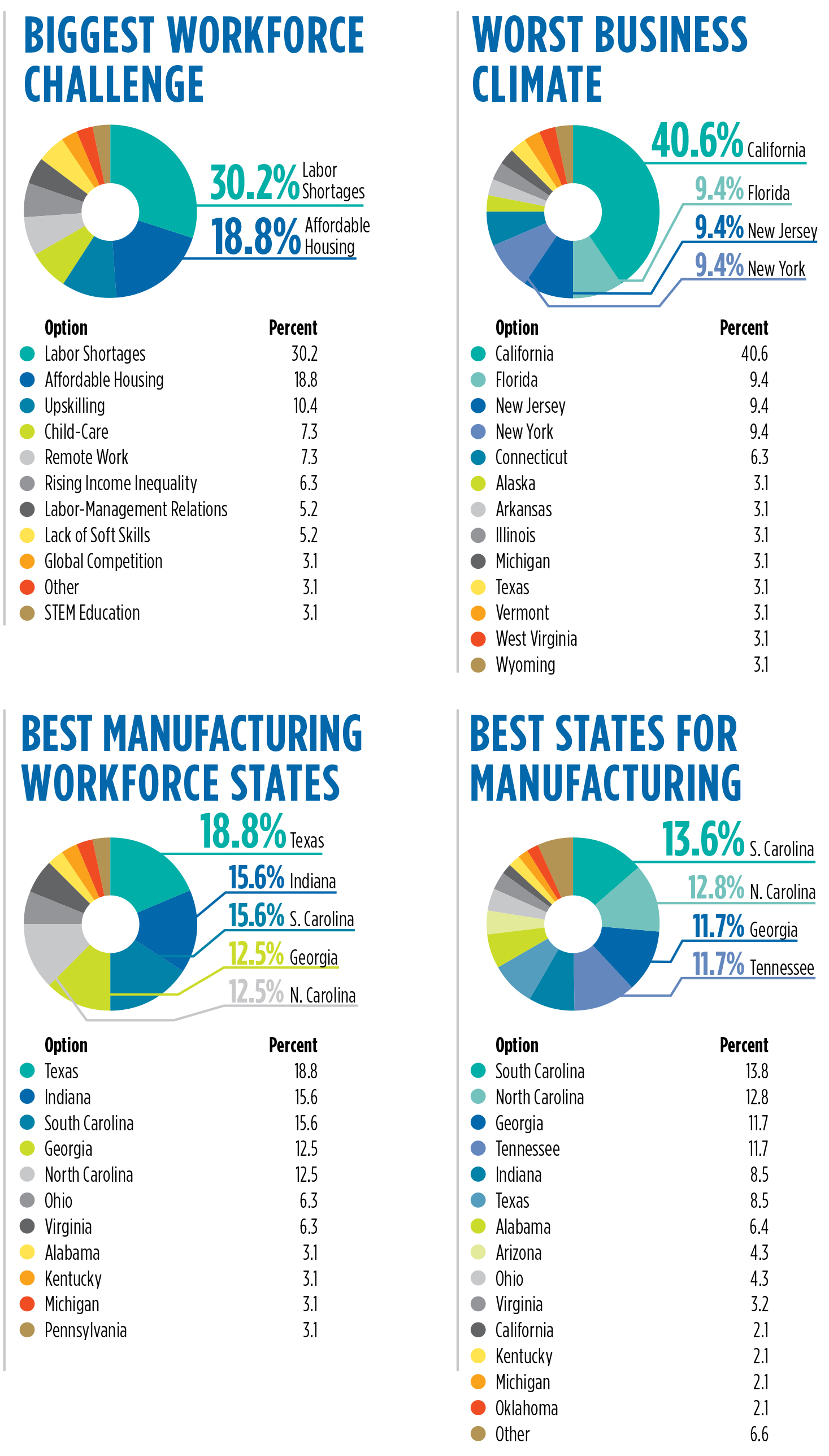

While there is a range of sentiments on specific locations, the South is king when it comes to perception. When we asked our national panel of site selectors to name the top state business climates in America, the respondents — 32 in total — voted for a clear-cut top four: Texas, North Carolina, Georgia and Tennessee, in that order.

Tying for fifth place were Florida and Virginia, followed by Alabama, South Carolina, Ohio and Indiana. California was ranked the worst business climate in the nation with 40.6% of the vote.

Digging deeper, we asked consultants to list the best states for manufacturing projects, and again the South rose to the top. South Carolina, North Carolina, Georgia and Tennessee occupy the top four spots.

A breakthrough for the Midwest came when we asked respondents to name the best manufacturing workforces in the nation. Indiana, they said, has the second-best factory labor pool in the country. Texas is tops. Rounding out the top five in this category are South Carolina, Georgia and North Carolina.

From Richmond to Ireland

One sector that has seen a lot of movement since the beginning of the pandemic in early 2020 is corporate headquarters. So, we asked: “If you were running a company and needed to find a new home for its corporate headquarters, list three cities you would place on your short list.”

The top three HQ locations right now, according to consultants, are Dallas, Atlanta and Nashville. Austin and Charlotte tie for fourth. Completing the top 10 are Columbus, Miami, Phoenix, Richmond, Chicago and Denver.

The results mirror what’s happening in the real world. A CBRE Insights report in December showed that from 2018 to 2023, Texas attracted the most HQ relocations (209). Austin led the way with 66 projects, followed by Dallas with 32 and Houston with 25.

California led the way with the most corporate HQ projects lost to other states, according to CBRE. The report stated that 79 companies left San Francisco-San Jose, 50 left Los Angeles-Irvine, and 21 vacated New York City. The high costs to live and operate a business in those cities were cited as the primary cause of the relocations.

Looking beyond U.S. shores, we asked the site selectors to name their preferred destinations for international investment. Their top three choices were USA, Mexico and Canada. The rest of the top 10 was all over the map: India, Ireland, Germany, Vietnam, Singapore, Costa Rica and South Korea.

The Issues That Matter

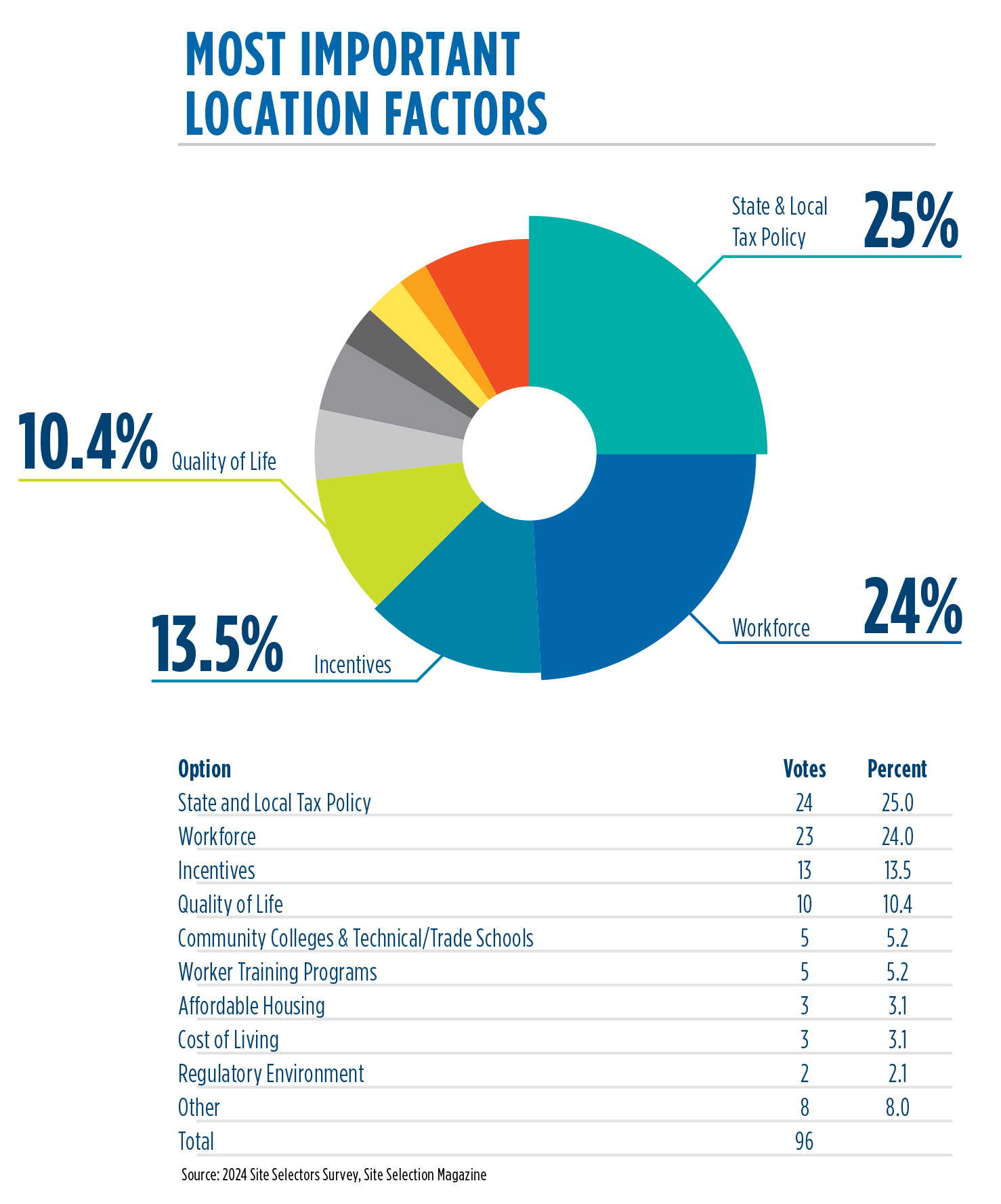

We also asked about issues. Two that matter the most are state and local tax policy and workforce. Respondents ranked these two factors as practically dead even in importance; each received roughly 25% of all first-place votes. Incentives and quality of life ranked No. 3 and No. 4, respectively.

To no one’s surprise, labor shortages were named the No. 1 workforce issue of the year, followed by affordable housing and upskilling. Child-care and remote work tied for fourth. Also ranked among the top 10 were rising income inequality, labor-management relations, lack of soft skills, global competition and STEM education.

Two new questions were added this year:

- How important is access to an innovation or technology hub to you?

- How important is a state’s commitment to sustainability principles to you?

Fully three-quarters of all respondents indicated that access to an innovation or tech hub was either somewhat important or extremely important to them. A solid majority (56%), however, said that a state’s commitment to sustainability principles either was not important, or they had no opinion on the matter.

Analyzing the Results

Sunbelt locations enjoying most-favored-destination status is nothing new, but Richmond, Virginia, and Ireland garnering lofty rankings shows that you don’t have to offer a subtropical climate to compete for capital projects.

Jennifer Wakefield, president and CEO of the Greater Richmond Partnership in Richmond, said her city’s eighth-place ranking as an HQ destination did not surprise her.

“Our location is one of our greatest advantages,” says Wakefield. “We are equidistant to Washington, D.C., and the Research Triangle; and we are equidistant to Boston and Miami. That’s one reason 11 Fortune 1,000 companies are headquartered here.”

The international property research data firm CoStar is building a new 1 million-sq.-ft. headquarters campus in downtown Richmond, and other firms are following suit. “We have been very intentional about marketing to corporate executives and site consultants, and our hard work is paying off,” says Wakefield.

Jessica Benson, who has spent much of the past two decades serving as an executive with IDA Ireland and Enterprise Ireland, says that “Ireland’s consistency is hugely valuable to companies. Access to skills is a key factor in Ireland’s business attractiveness as well. We are known globally for our talent.”

Benson adds that Ireland boasts the highest level of STEM graduates per capita in Europe and has been more open in its immigration policy than the U.S., leading to more tech talent choosing to relocate to the Emerald Isle.

“Ever since Intel opened its first plant in Ireland in 1989, the semiconductor manufacturing industry has been investing in Ireland,” she notes. “Some $17 billion in new Intel investment is flowing into Ireland now, and more is coming.”

Pro-business tax policy and access to a European Union market of 440 million add to the business appeal of Ireland.

Digging into why the Carolinas are the manufacturing darlings of the consulting profession, Didi Caldwell, founder and principal of Global Location Strategies in Greenville, South Carolina, says the numbers add up for both states.

“Low costs, existing workforce, low labor unionization, right-to-work, growing population and competitive energy costs” are key factors keeping the Carolinas on top for factory projects and jobs, says Caldwell. “Momentum influences perception, which further supports momentum. Plus, Greenville and Charleston consistently rank as the best places to retire, raise a family, or enjoy a girls’ weekend.”

In other words, the sun is not setting on the Sunbelt anytime soon.