A new report from Cushman & Wakefield outlines shifting supply chains. We speak to one of its co-authors about the implications.

In May, Cushman & Wakefield released “Waypoint 2025,” the inaugural edition of a global logistics and industrial outlook report that draws on insights from more than 120 markets worldwide. Here we showcase adapted excerpts of the report’s findings and speak with two of the firm’s global logistics leaders. — Ed.

The movement of goods has always been complex, and today’s intricate supply chains make it even more so. With production often far from consumption, goods must traverse long distances to arrive where and when they’re needed. Shifts in consumer behavior have further complicated product handling and last-mile delivery strategies. Despite these challenges, one constant remains: The production and movement of goods depend on real estate. The right real estate varies by business, but understanding market conditions is crucial for negotiating transactions.

Market Drivers

Trade and consumption are the fundamental drivers of demand for logistics and industrial real estate. While structural drivers — such as the shift to sustainable buildings to meet ESG objectives and improve operational and cost efficiency — also influence the types of properties users seek, trade and consumption remain the bedrock of demand for this sector.

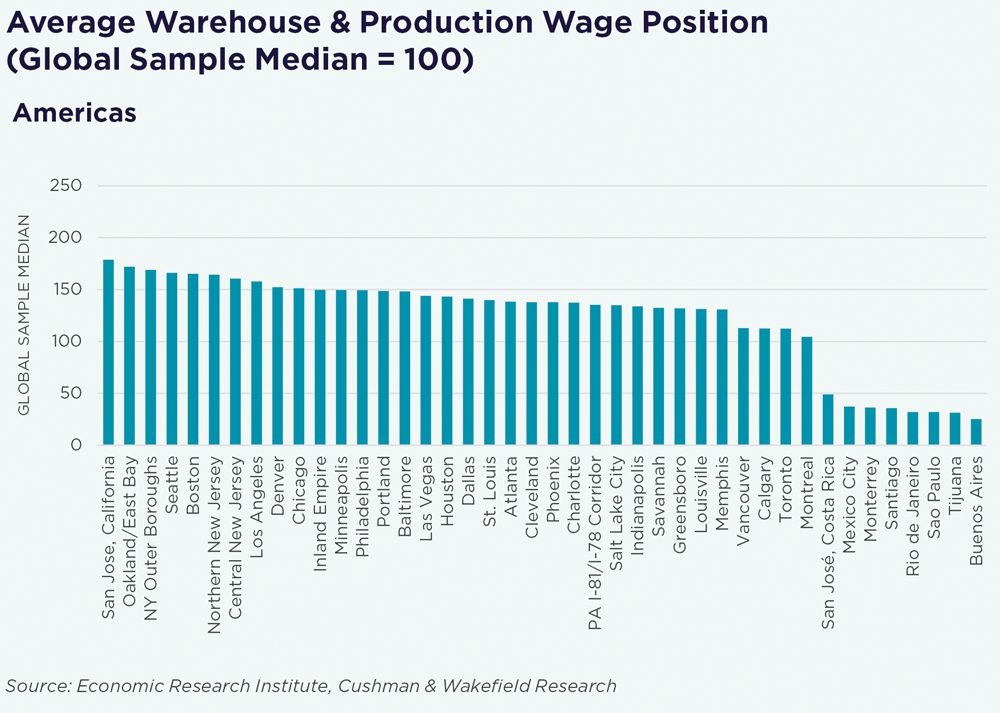

Over the past 50 years, global trade has surged, driven by advancements in logistics such as containerization and information and communication technology (ICT) networks, which reduced transaction costs and strengthened international trade links. Businesses expanded geographically, reorganizing their global value chains to capitalize on lower production and labor costs in regions like APAC (particularly India, Malaysia, Vietnam and on the Chinese mainland), Latin America (especially Mexico and Costa Rica), and manufacturing hubs in Central & Eastern Europe (CEE) and Southern Europe. This shift transformed Asia into a global manufacturing hub, while the proliferation of trade agreements further shaped the global flow of goods.

In this changing era of globalization, new priorities such as resilience, diversification and flexibility are reshaping supply chain strategies. Businesses are increasingly diversifying supplier bases to reduce reliance on single geographies and mitigate risks of disruption. Nearshoring has also gained traction, bringing production closer to markets of consumption to enhance control and flexibility. Regions like CEE and Southern Europe, North Africa, Mexico, Costa Rica and other LATAM countries are key beneficiaries of this trend.

The rapid pace and scale of disruptions have underscored the critical need to adapt supply chain and logistics networks swiftly and effectively to meet changing conditions and expectations. As a result, location strategy continues to evolve, with significant implications for real estate requirements on the ground.

Retail typically accounts for 25-30% of new logistics and industrial leasing activity, with third-party logistics providers contributing an additional 27-33%. While traditional “bricks and mortar” retail remains dominant, online retail is the fastest-growing retail segment and a key driver of logistics space demand.

Regardless of retail channels, retailers’ logistics decisions revolve around two key principles: maximizing customer experience and minimizing cost to serve. Amid this complexity, retailers must make strategic real estate choices, including the location of logistics nodes, the specification of the buildings and the ways in which they operate them — including the use of people and technology — to satisfy these two competing demands of experience and cost. This may also involve using retail spaces for online fulfilment functions such as delivery-from-store, in-store collections and customer returns processing.

The Challenge of Uncertainty

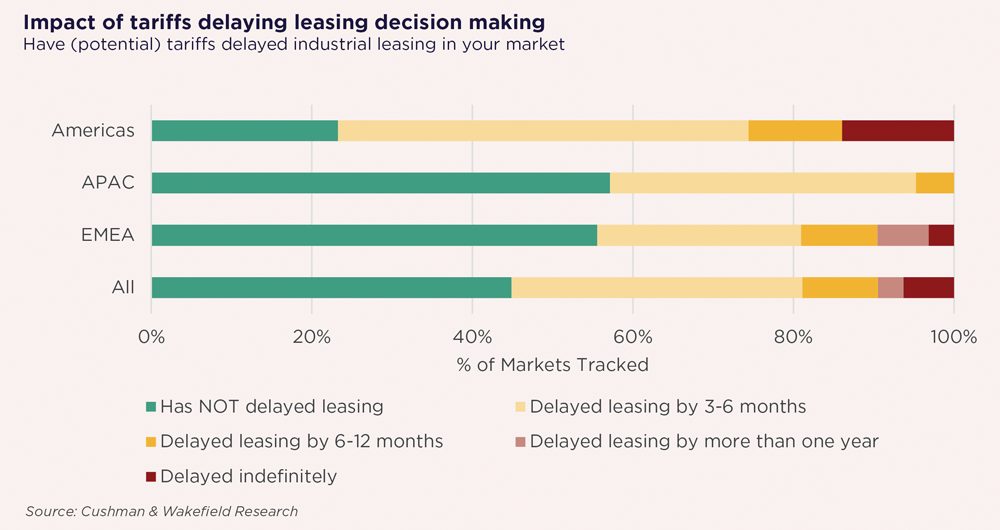

Over the past two decades, events like the GFC, the COVID-19 pandemic, major conflicts and extreme weather have disrupted the movement of goods around the world. More recently, the Trump administration, following a hard economic shift, introduced significant shocks to the global economy via unilateral tariffs on U.S. imports. Trade disruptions are not new, and supply chains have consistently adapted to changing trade dynamics in the past — and will continue to do so.

The current trade and macroeconomic environment remains highly fluid. Accordingly, it is appropriate to take a broader view of current conditions to identify key issues, rather than focusing on specific outcomes:

- Dynamic tariff changes suggest they may have peaked and are likely to ease over time. Therefore, business decisions should be made with a broader, long-term lens.

- Should any tariffs remain, the impact on businesses, consumers, economies and property markets will depend on any differentiation between products and countries. This is highly nuanced and will require granular analysis.

- Globally, confidence has weakened, slowing near-term economic growth, but potential central bank interventions could drive a rebound in 2026.

- Emerging demand for logistics and industrial real estate is expected, with increased defense spending in EMEA as a key example.

Property Costs

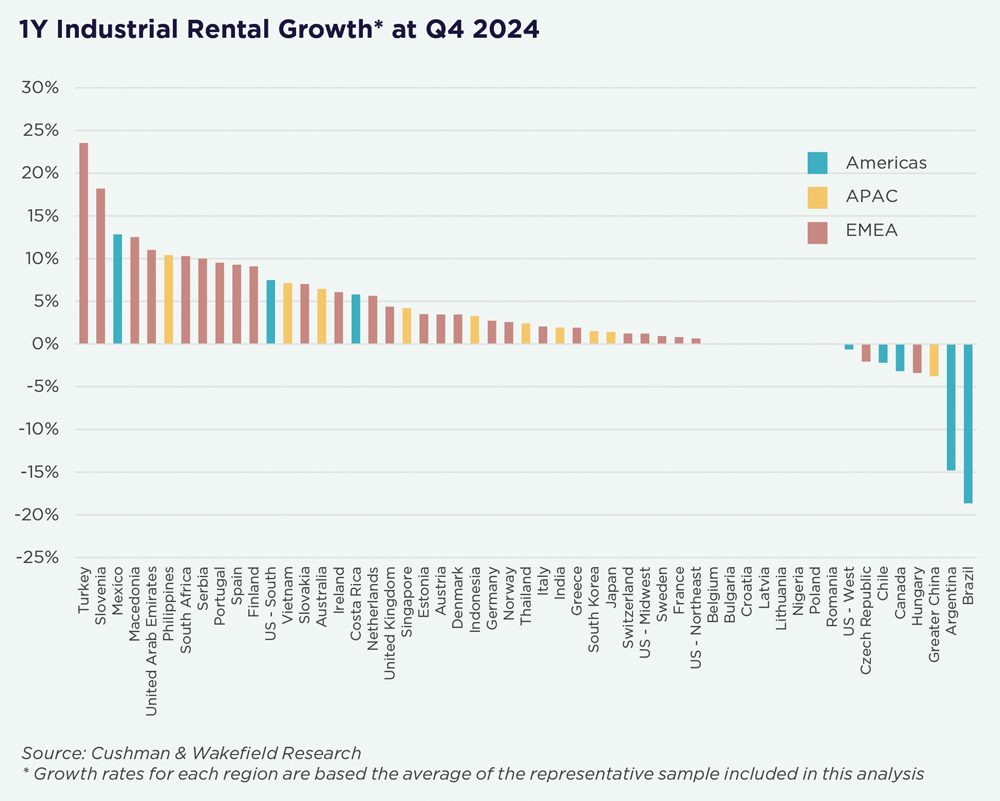

Property market trends over recent years, marked by strong occupier demand and limited space availability, have driven strong rental growth across regions. Many markets worldwide have set record-high rental levels, with some seeing rents more than double in the past five years.

Rents, on average, are 41% higher globally compared to the end of 2019. The U.S. led this trend, with rents 57% higher than they were five years ago. Propelled by markets in New Jersey and Pennsylvania where demand was particularly strong, the Northeast region experienced particularly strong growth at an average of 84% over the five-year period, while the South and Midwest posted more modest rent growth.

The West initially recorded substantial growth between 2021 and 2023, but 2024 brought notable declines due in part to cooling demand and rising vacancy rates. Rents in the rest of the Americas have been more volatile, with declines in 2020, a rebound from 2021 to 2023, and some regions reporting declines again in 2024.

Rents in EMEA have followed a similar growth trajectory, now averaging 38% above 2019 levels. Growth has been particularly strong in the UK, Czech Republic, Netherlands and Norway, while Turkey’s 90% increase over five years was largely due to high inflation, peaking at 85.5% in October 2022 and standing at 38.1% in March 2025.

In APAC, rents are on average 25% higher than in 2019, with notable variation across markets. Australia and Vietnam recorded increases of over 70%, while rents in India, Japan, Thailand and the Chinese mainland have remained largely flat.

Rental growth has slowed noticeably over the past year. Globally, rents grew by an average of 16.1% in 2022, 6.9% in 2023 and just 2.9% in 2024. This slowdown has been most pronounced in the Americas. In the U.S., rental growth dropped significantly from 22.6% in 2022 to 2.4% in 2024, reflecting rising vacancy rates.

Outside the U.S., markets in the Americas experienced a sharp decline, with rental growth plummeting from 23.2% in 2022 to -1.9% in 2024. Rental levels fell in nearly every Canadian and Latin American market in 2024.

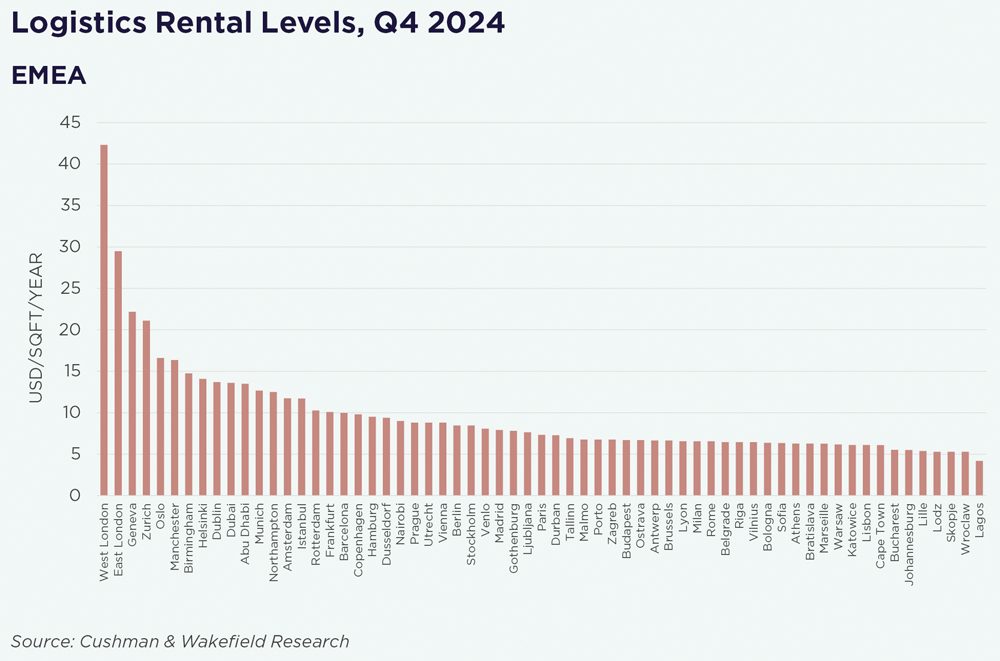

Of the 126 markets analyzed in this report, 76 fall within the range of US$5 and US$10 per sq. ft. (psf) per year. This includes 71% of EMEA markets and about half of the markets in both the Americas and APAC.

Only a handful of markets exceed US$20 psf per year. These include London, the New York City outer boroughs, Hong Kong and the Swiss cities of Geneva and Zurich, where limited land availability for logistics and industrial uses leads to high competition for space and elevated rents.

Other high-rent markets include major port locations like Los Angeles, New Jersey, Vancouver and Oakland, where the proximity to port operations creates inelastic demand and drives up prices.

At the lower end of the spectrum, APAC has the most markets priced below US$5 psf per year, including the manufacturing hubs of Vietnam, Thailand and especially India, which are highly cost-competitive globally.

In the Americas, cost-effective markets include Rio de Janeiro and São Paulo, and locations in the Midwest and South of the U.S. In EMEA, Lagos, Nigeria, is the only market priced below US$5 psf per year, though markets in South Africa, parts of CEE and Southern Europe are also highly competitive.

Cost of Electricity

Access to energy is becoming a critical factor in occupiers’ decision-making processes. The growing energy demands of modern warehouse operations — driven by automation, warehouse management systems, material handling equipment and the shift to electric vehicle technologies — are increasing overall energy costs.

Electricity costs are highest in Europe, driven by many countries’ reliance on imported gas to generate power, as well as regulatory taxes, and transmission and distribution costs. While prices have moderated in some countries, they remain above pre-pandemic levels.

Countries at the lower end of the price spectrum typically have access to primary fuels like gas and coal or investments in nuclear and renewable energy like wind, solar and hydro, which benefit from lower electricity costs.

The focus on securing energy with lower financial and environmental costs is shaping locational choices, even down to the asset level. Whether it be through greater proportions of renewables in the transmitted energy source mix or through the on-site creation of energy for individual use (such as solar PV on warehouse roofs), occupiers are looking closely at the type of energy available for individual sites as well as the cost and reliability of supply.

Current Market Conditions

Globally, over half of the 126 profiled markets are tenant-favorable, driven by a recent slowdown in occupier demand, which has pressured landlords to secure deals. This trend is most pronounced in the Americas, especially in the U.S., where declining occupier demand, along with a high volume of new space delivered or in the pipeline, allows tenants to negotiate favorable terms.

Only 25% of markets are landlord-favorable, with EMEA leading due to supply constraints, either from a lack of available land for delivery or developers’ hesitation to launch new projects. APAC offers more balanced conditions, with 43% of markets neutral, 24% favoring landlords and 33% favoring tenants. Rapidly expanding markets in India remain neutral as new supply keeps pace with healthy occupier demand. However, tighter vacancy and limited supply pipelines across Australia and Southeast Asia give landlords the upper hand. In contrast, the remainder of the region faces weaker demand or an influx of new supply, enhancing tenant leverage.

Globally, the market is expected to shift toward neutral and landlord-favorable conditions, moving away from the current tenant-favorable trend. In three years, market expectations are as follows:

- Only 28% of markets will remain tenant-favorable, down from the current 52%.

- Landlord-favorable markets will rise to 35%, compared to 24% now.

- Neutral market conditions will increase to 36%, up from 23% currently.

In the Americas, a major shift is expected from the current tenant-favorable market conditions toward neutral and landlord-favorable positions. Currently, 72% of markets are tenant-friendly, but this is expected to drop to 23% in three years. This shift is particularly pronounced in the U.S., where 19 of the 26 markets currently favoring tenants are expected to move to neutral or landlord-favorable conditions in the next three years. Landlord-favorable markets are expected to rise to 42%, compared to the current 19%.

In EMEA, around half of all markets expect a shift in market tenor. Similar to the Americas, a decline in tenant-favorable markets is expected over the next three years, with an increase in landlord-favorable conditions. Most markets (40% compared with 25% now) foresee neutral conditions, suggesting a more balanced position than in recent years.

In APAC, expectations differ from those in EMEA and the Americas. Over the next three years, the market is expected to move away from a balanced, neutral position toward more polarizing tenant- and landlord-favorable market conditions. Neutral markets are expected to decline to 29% from the current 42%, while tenant-friendly markets are anticipated to grow to 38% from 33%. Similarly, landlord-favorable markets are expected to rise to 33%, up from 24% today.

Key Takeaways

Supply chain resilience and diversification: Businesses are reconfiguring supply chains to prioritize resilience and flexibility, including diversifying supplier bases and exploring nearshoring strategies.

E-commerce growth continues to drive demand: Rapid growth in e-commerce, which has surged globally by 289% over the past decade, is fueling demand for diverse logistics facilities. It is the primary driver of space demand over the next three years in the Americas and EMEA, and the third largest driver in APAC.

Rental growth outlook: Despite recent moderation, more than half of global logistics and industrial markets are projected to experience rental growth through 2027, driven by robust occupier demand and increasing supply in key regions.

Adapting to market conditions: Tenant-friendly conditions dominate in many markets, but a shift toward neutral and landlord-favorable conditions is expected over the next three years, particularly in North America and EMEA.

Long-term vision amid uncertainty: Businesses are balancing short-term challenges like economic slowdowns and rising tariffs with long-term strategies to optimize location, supply chain configurations and real estate decisions for sustainable growth.

Cost pressures shaping real estate decisions: Rising costs for construction materials, energy and labor are influencing locational and operational decisions, with markets in APAC, LATAM and EMEA offering cost advantages in labor and energy expenses.

Against this backdrop, potential stakeholder strategies for occupiers include:

- Leverage uncertainty to diversify and strengthen supply chains, including reassessing location and real estate needs.

- Act on “mission critical” sites now, as tenant-friendly conditions are expected to shift soon. Secure current assets or plan for new facilities, particularly in markets where vacancy rates may tighten.

- Prepare for rising real estate costs in the near term, including higher rents and increased fit-out and construction expenses due to fluctuating material costs.

3 Questions for Cushman & Wakefield

The Waypoint report forecasts tenant-favorable markets dropping from 52% today to 28% by 2028 (72% to 23% in the Americas). Name a few locations that are tenant-favorable today and will be in 2028. Are there any locations that you see becoming tenant-favorable by 2028 that may not be today?

Jason Price, Senior Director, Americas Head of Logistics & Industrial Research: By 2028, most, if not all industrial markets across the Americas are expected to be in growth mode as we should be in a new industrial expansion cycle. Some markets which are tenant favorable today which should remain tenant favorable would be possibly Austin and Las Vegas, as they have seen robust speculative supply totals in recent years, putting vacancy rates in double digits. Although by 2027 these markets should start to see some stabilization, vacancy will still be elevated with numerous space options for occupiers. We don’t see markets becoming tenant favorable in 2028 that aren’t today.

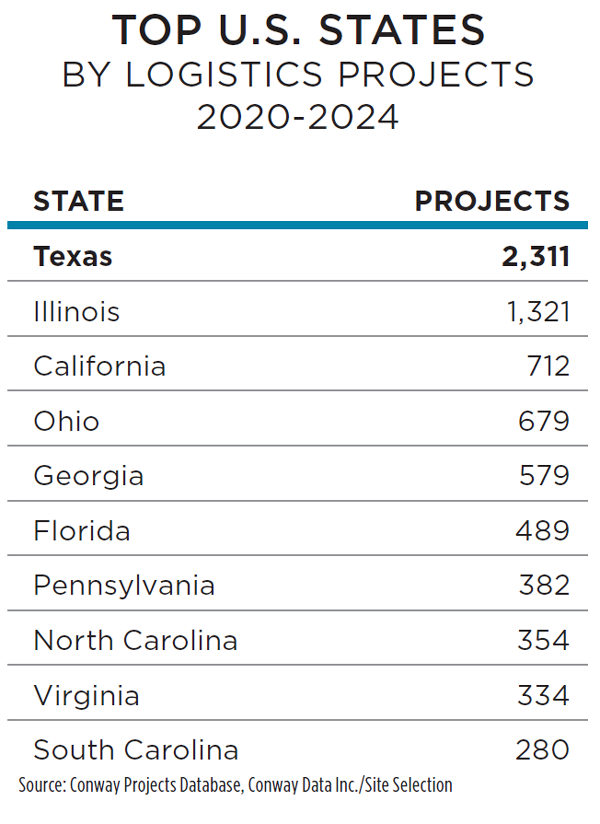

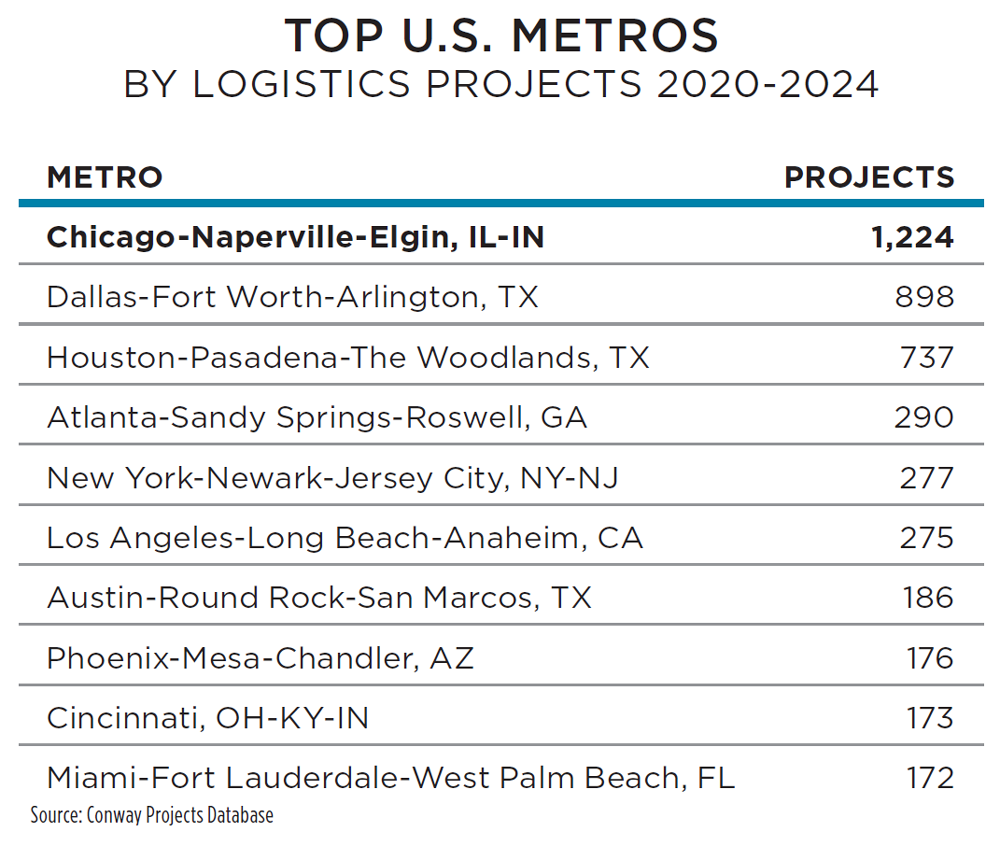

The charts here show top states and metros by corporate end-user major logistics facility investment projects over the past five years as tracked by Site Selection’s Conway Projects Database. What stands out to you?

Jason Price: Texas being high on this list is of no surprise — due to the lack of state income tax, it has a pretty favorable environment in terms of regulations vs. other states and has a large/diverse employment base with healthy population growth across its major metros. The state also has a plethora of developable land for projects. Investment into the Chicago area specifically is due to its strategic location in the Midwest and strong transportation network. It’s another area with a highly skilled workforce. It boasts one of the largest populations nationwide as well and access to other Midwest hubs, and has one of the largest freight transportation networks in the U.S.

The manufacturing and logistics opportunity in India continues to appear great. But the stereotype of lagging or non-existent Indian transport infrastructure is hard to shake. Where in India have you observed the most dramatic improvements?

Ahishek Bhutani, Managing Director, Logistics & Industrial Services – India: In recent years, India has improved its rank significantly in the Logistics Performance Index of 2023 at 38 out of 139 countries that the World Bank evaluates. Its previous rank was 44 in 2018. However, India still has some issues with regard to cost of transportation being relatively high and lack of enough specialized goods storage facilities, i.e. Grade-A warehouses. Having said that, the government is investing heavily in creating the necessary infrastructure for multi-modal freight corridors, enabling higher use of railways and integrating waterways, wherever possible. Such initiatives have led to unfolding of industrial/logistics opportunities in several satellite towns and tier-II cities such as Sanand & Bavla (in Ahmedabad); peripheries of Mumbai, Pune, Bangalore & Chennai; Greater Noida, Dahej (Gujarat), Indore, amongst a few others. We have observed a lot of land deals in these locations that would cater to industrial developments in the near future.