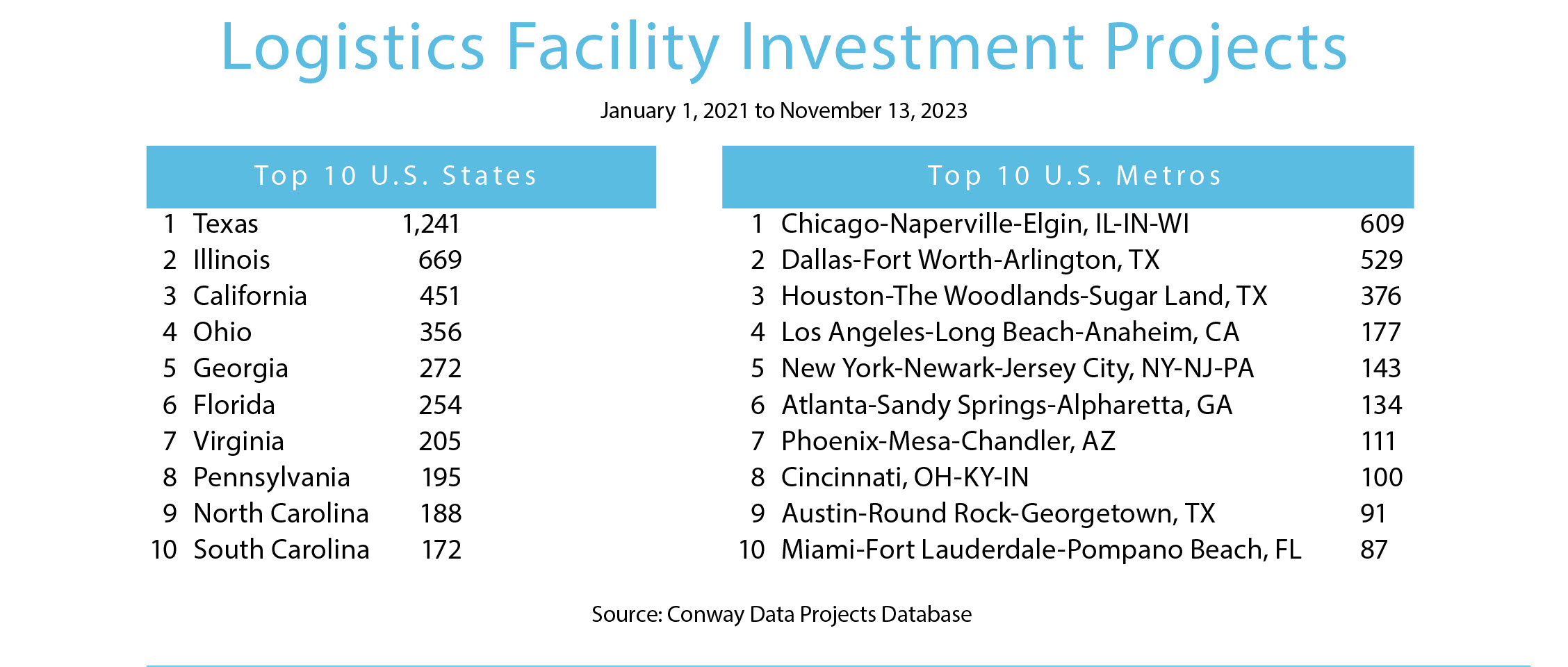

From New Year’s Day 2021 to mid-November 2023, Site Selection’s Conway Projects Database has tracked 6,282 U.S. facility investments with a logistics function. Nearly 20% of them were in Texas.

No wonder Port Houston in October reported its biggest month ever for loaded exports, and year-to-date container imports up by 32% compared to the same period in the pre-pandemic year of 2019. That single port supports economic activity totaling $439 billion in Texas — nearly 20% of Texas’ total GDP — and $906 billion in economic impact across the nation.

Among the facilities lining up at Port Houston to make their own impact is a new 315,000-sq.-ft. Houston ColdPort facility from temperature-controlled REIT and integrated solutions provider Lineage Logistics, which marked the facility’s grand opening in November.

“We are excited to strengthen our presence in Houston at such a pivotal time for the market,” said Brian Beattie, Lineage’s president of North American West. “The city has recently seen a surge in port demand amid congestion and other issues at the big ports on the West Coast. By adding ColdPort to our Houston network, Lineage’s customers have another option to help manage their costs and increase productivity. Additionally, they’ll have better access to our world-class global network,” which numbers more than 400 facilities with more than 2.5 billion cubic feet of capacity.

Lineage currently employs more than 1,200 team members across its 19 facilities in Texas — six of them in Houston. Those 19 facilities have a combined capacity of more than 189 million cubic feet (7.5% of the company’s global total) and approximately 532,000 pallet positions.

The Rest of the Story

All top 10 states for logistics projects last year except Georgia raised their totals, and all 10 stayed within the top 10 this year. Texas (up by 233) and California (up by 97) displayed the largest upward spikes, while a few states shifted places by one or two spots.

As for metros, No. 1 Chicagoland knows how to stay No. 1, with more than 600 projects. That was up by nearly 30 from the previous period examined one year earlier. But Dallas-Fort Worth and Greater Houston, Nos. 2 and 3 respectively, shot up by nearly 100 projects each. And Greater Los Angeles, despite that port congestion reputation, tallied 40 more projects than that previous period to reach No. 4 with 177 projects.

Among the sharpest upward movers in the top 20 is the bi-state Kansas City region, which with 73 projects moved from No. 18 to No. 14. Among the projects landing there is a new 300,000-plus-sq.-ft. facility near the CPKC intermodal terminal in South Kansas City, Missouri, from Vertical Cold Storage that will employ around 130 individuals at a site centrally located within 30 miles of BNSF, Union Pacific and Norfolk Southern terminals.

The leader of one company expanding in that area — Radiant Logistics, which established a new office in the Kansas City suburb of Overland Park, Kansas — offers some insight into this year’s top international logistics locations too:

“We’re seeing some of our customers begin to pivot to Southeast Asia or Mexico,” said Bohn Crain, Radiant’s founder and CEO, in an earnings call in the fall. “Certainly, China is not going away. But it remains soft. Right now would typically be a go-go time and we’d be at the absolute height of peak season right now. It’s muted at best. Mexico and Southeast Asia have ever so slightly taken market share from China. I think we’re seeing an acceleration of some of those strategies, tipping even more heavily toward Mexico.”

Mexico comes in at No. 4 in our facility project tallies behind No. 1 Canada, No. 2 United Kingdom and No. 3 Australia, with projects evenly distributed among the states of Baja California, Coahuila de Zaragoza, Guanajuato, Mexico and Nuevo Leon, where DHL Supply Chain in November inaugurated its new Gaia II logistics center in Ciénega de Flores, expected to generate up to 2,000 direct and indirect jobs when all three phases are complete.

Ontario dominates the Canadian scene. Leading regions in the UK include Northamptonshire, Birmingham, Leicestershire and Bristol, while Brisbane in Queensland just outraces Melbourne in Australia.