Where have the top 10 pharma and top 10 biotech firms invested over the past five years? And how does their facility investment activity correlate to their market cap performance today?

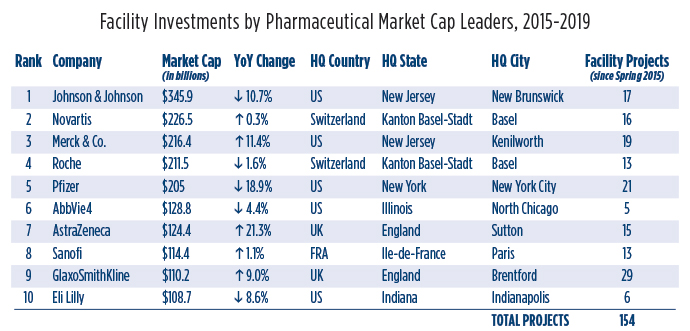

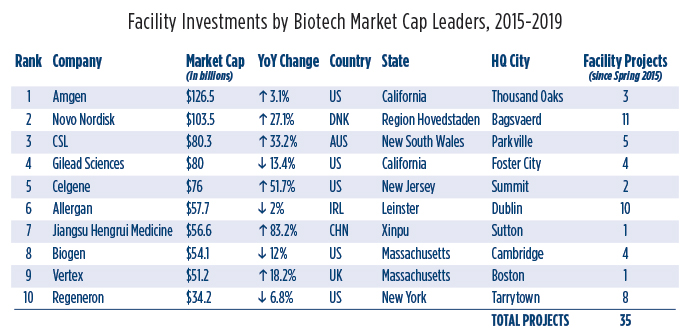

We set out to answer that question by listing the names and total market cap amounts of the top 10 of each (found in Genetic Engineering News’s publication of them in November 2019), then diving into the Conway Analytics database. What we found from these 20 firms was nearly 200 facility investments around the world since early 2015.

The busiest has been the No. 9 pharma company in the world, GSK, with 29 projects. Its market cap of over $110 billion was up 9% in November over the previous November.

Pfizer, whose market cap of just over $205 billion was down by 18.9% but nevertheless good enough for No. 5 in the world, was No. 2 in projects with 21. Merck & Co., No. 3 in market cap ($216.4 billion, up 11.4%) was also No. 3 in projects with 19.

Altogether, Site Selection has tracked 154 projects from the top 10 pharma giants, and 49 projects from the top 10 biotech firms, led by Novo Nordisk (No. 2 in biotech market cap at $103.5 billion, up 27.5%) with 11 projects. Ireland’s Allergan was second in projects with 10 facility investments, and No. 6 by market cap at $57.7 billion, down 2%.

Top Dollar from Top Firms

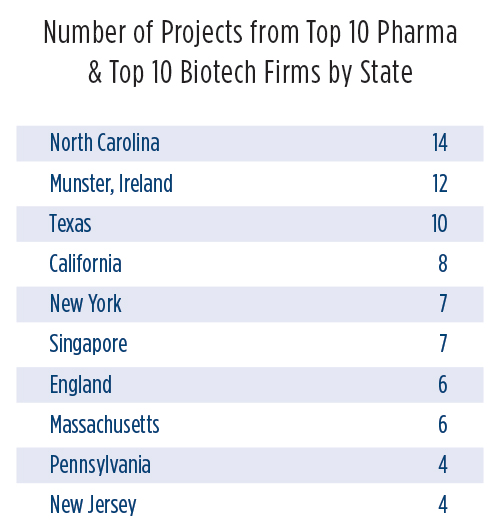

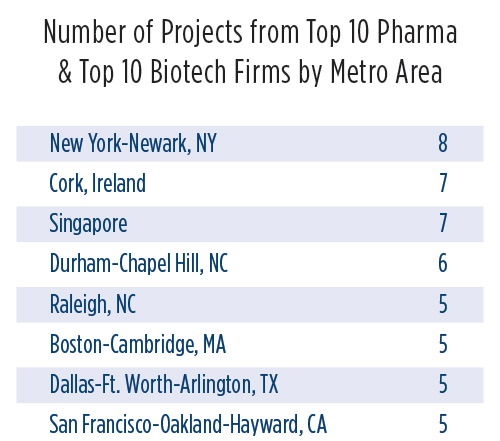

Sorting through the data related to these nearly 200 facility investment projects from industry leaders over the past five years reveals that, by state or province, North Carolina (with 14 projects); Munster, Ireland; and Texas top the list. Sorted by defined metro area, the leaders are New York-Newark (eight projects); Cork, Ireland; and Singapore. But that’s where it pays to look more closely at the data.

Though everyone think of a certain region of North Carolina as the Raleigh-Durham-Chapel Hill area, Raleigh-Cary and Durham-Chapel Hill are defined by the U.S. Census Bureau as two separate metro areas. Adding their project totals together would result in the region being declared No. 1, with 11 projects.

A scroll through all 20 of these leaders’ newsrooms reveals some investment trends. Cancer and diabetes lead the list of maladies these companies are attempting to cure or treat. And yes, traditional life sciences hubs in North Carolina, Massachusetts and California figure prominently. Here’s a highlight reel from a few of the busiest market-cap leaders in recent months:

Novartis

In November 2019, Novartis inaugurated a new manufacturing facility for cell and gene therapies in Stein, Switzerland. “Our site in Stein is vital for new launches of solid and liquid drugs,” said Steffen Lang, global head of Novartis Technical Operations. "The construction of the new manufacturing facility is another investment in the production of breakthrough cell-based therapies that can potentially change the lives of patients.”

Amgen

Amgen in December 2019 announced the signing of a lease with BioMed Realty for a new 240,000-sq.-ft. research facility in the Gateway of Pacific campus development in South San Francisco, California, where the company has had operations for 15 years. The new location, currently under construction at Oyster Point, will house Amgen’s Bay Area employees focused on cardiometabolic, inflammation and oncology research. "At Amgen South San Francisco, we are home to top scientific talent, integrating human genetics with core biology and molecular engineering to discover and develop first-in-class therapies," said Amgen’s South San Francisco site-head Flavius Martin, vice president, Research, Oncology and Inflammation. "The new location will foster even greater collaboration across our strong scientific team, accelerate the R&D process, and provide a venue for increased engagement with the Bay Area’s abundant scientific and educational communities."

Gilead Sciences

In April 2019, Kite, a Gilead company, announced plans for a new facility on a 20-acre site in Frederick County, Maryland. The facility will become part of Kite’s growing commercial manufacturing network that includes sites in California and the Netherlands.

Pfizer

Pfizer in August 2019 announced an additional $500 million investment for the construction of its gene therapy manufacturing facility in Sanford, North Carolina, southwest of Raleigh. The facility is anticipated to support Pfizer’s continuing investment in gene therapy research and development, similar to Pfizer’s Chapel Hill and Kit Creek, North Carolina, R&D sites. The expanded facility is projected to add approximately 300 new jobs to the 650 in Sanford, part of a statewide Pfizer payroll of more than 3,600. Mike McDermott, president, Pfizer Global Supply, said the investment “is part of our overall plan to invest approximately $5 billion in U.S.-based capital projects over the next several years.”

In May 2019, Pfizer opened a new $200 million, 175,000-sq.-ft. manufacturing facility in Andover, Massachusetts. Pfizer’s seven-building Andover site houses commercial manufacturing and product development functions, with colleagues dedicated to the development and production of high-quality complex biologics and vaccines. “With its modular and flexible design, the newly opened Andover Clinical Manufacturing Facility (ACMF) will expand the capacity for Pfizer’s BioTherapeutics Pharmaceutical Sciences organization to manufacture clinical supplies,” the company said. The site will provide 75 new jobs, adding to approximately 2,000 Pfizer colleagues currently based in Massachusetts.

Novo Nordisk

In February 2020, Novo Nordisk announced plans to invest 800 million Danish krone (around US$115 million) in upgrading and expanding facilities at its diabetes treatments production site in Kalundborg, Denmark. The projects are expected to be completed in 2022.

“Today, we manufacture around half of the world’s insulin in Kalundborg where we have been present for 50 years,” said Michael Hallgren, senior vice president for Novo Nordisk production in Kalundborg. “Since the turn of the millennium alone, we have invested more than DKK 16 billion [US$2.3 billion] in these facilities, which are a cornerstone of our global production network.”

Established in 1969, the site covers a total area of 1.2 million square meters (12.9 million sq. ft.) and employs more than 3,000 people. Novo Nordisk and Novozymes are active partners of the Kalundborg Symbiosis, a resource partnership among six private companies and three public operators. The main principle of the industrial symbiosis is that a residue or byproduct from one company becomes a resource in another company’s production process. Today, 22 different types of resources are exchanged in the network.

Biogen

Biogen in 2019 announced that it has entered into a share purchase agreement with FUJIFILM Corporation under which Fujifilm will acquire the shares of Biogen’s subsidiary, which holds Biogen’s biologics manufacturing operations in Hillerød, Denmark, for up to $890 million.The approximately 800 employees at the Hillerød subsidiary are expected to continue employment under Fujifilm ownership, as the company uses the Hillerød site to produce commercial products for Biogen. “As we continue to diversify our portfolio across multiple modalities and bring online our state-of-the-art manufacturing facility in Solothurn, Switzerland, we believe that we have enhanced our manufacturing capabilities and capacity for biologics with this transaction,” said Michel Vounatsos, Biogen’s CEO. Biogen also operates a manufacturing site in Research Triangle Park, North Carolina.

AstraZeneca

AstraZeneca in November announced three large-scale initiatives to build on its commitment to China and advance global R&D for innovative new medicines. The company will create a new Global R&D Center and an artificial intelligence (AI) Innovation Center, both in Shanghai, and also create a first-of-its-kind, $1 billion Healthcare Industrial Fund with China International Capital Corporation Limited (CICC).

Based in the Jing’an district of central Shanghai, the Global R&D Center will more than double AstraZeneca’s Shanghai R&D headcount to around 1,000. As a first step, the fund will support domestic companies and partners including those based in the Wuxi International Life Science Innovation Campus.

Also part of AstraZeneca’s overall plan is the establishment of five regional headquarters in China, with Beijing as North region HQ, Chengdu as West region HQ, Guangzhou as South region HQ and Hangzhou is East region HQ, in addition to Wuxi, which covers the Central region. AstraZeneca will establish local commercial innovation centers in each HQ.

CSL Limited

In August 2019, Australia-based biotech leader CSL announced it would work with developer PDG to build a new, 16-story global corporate HQ and R&D complex in the Parkville biomedical precinct of Melbourne, on the northern edge of the city’s central business district. With completion scheduled for 2024, the new HQ will accommodate more than 800 CSL employees. The company will maintain its presence at the Bio21 Institute, which currently accommodates 130 CSL researchers, while Seqirus’ influenza and antivenom manufacturing operations will remain at the current Poplar Road HQ campus for the foreseeable future.

"Melbourne’s reputation as a world class center of biomedical research excellence is well established,” said CSL CEO and Managing Director Paul Perreault. “The medical research cluster centered around Parkville — comprising the University of Melbourne, the Walter and Eliza Hall Institute of Medical Research, the Doherty Institute for Infectious Disease, The Murdoch Children’s Research Institute, the Victorian Comprehensive Cancer Centre, the Royal Melbourne Hospital, the Royal Women’s Hospital, The Peter MacCallum Cancer Centre and the Royal Children’s Hospital, among other institutions — is considered a world-class medical precinct and a significant research presence in global terms."

Sanofi

In October 2019, Sanofi inaugurated a new digital manufacturing facility at the company’s integrated, cross-functional biologics hub in Framingham, Massachusetts, where Sanofi has been located for more than 30 years. The facility’s advanced paperless and data-driven manufacturing technologies are expected to enable Sanofi to achieve higher levels of productivity, agility, and flexibility, reducing the time it takes for products to move from the development labs to the manufacturing plant. Framingham is the first “digitally born” facility while similar digital transformations are introduced at legacy plants in Toronto (Canada), Suzano (Brazil), Waterford (Ireland), Sisteron (France), and Geel (Belgium).

Regeneron Pharmaceuticals

Known for its incremental investment over many years in its hometown of Tarrytown, New York, Regeneron and Cold Spring Harbor Laboratory in December 2019 announced the launch of the $4 million, 4,700-sq.-ft. Regeneron DNA Learning Center at Regeneron’s Sleepy Hollow campus in Westchester County. The newest of Cold Spring Harbor Laboratory’s nine teaching labs, the Regeneron DNA Learning Center offers hands-on experimentation to a diverse group of local pre-college students. The goal of this program is to increase awareness, access and exposure to STEM at a young age and inspire students to pursue careers in STEM fields.

Eli Lilly and Company

The Indianapolis-based healthcare and biopharma company in January pledged to invest over $470 million and create more than 460 new jobs at a new pharmaceutical manufacturing facility in Research Triangle Park in Durham, North Carolina. The new site will produce parenteral (or injectable) products and delivery devices. Lilly currently has seven manufacturing sites located in the United States in Indiana, New Jersey and Puerto Rico.

"In the past two years, we have invested billions of capital in new U.S.-based manufacturing because the 2017 tax reform rebalanced the playing field in favor of the American worker,” said David A. Ricks, chairman and CEO of Lilly. The average salary for all the new positions will exceed $72,000.

The news came less than two months after Lilly announced it would invest $400 million

and create around 100 new jobs at its manufacturing facilities at the Lilly Technology Center campus in Indianapolis. The investment will include enhancements to existing manufacturing facilities that make insulin, additional capacity for its growing portfolio of diabetes medicines and initial capital investments for future medicines. As in Durham, Ricks credited the federal tax reform passed in 2017.

"With more capital available as a result of tax reform, Lilly and other Indiana companies are able to re-invest and expand production here at home,” he said. “This is crucial for us to continue to advance our state’s economy and drive future investment — adding high-tech jobs and facilities that keep Indiana competitive in the global marketplace.”

Between those two announcements, Lilly in December unveiled its first shared innovation lab in the hot spot of South San Francisco, California. Lilly Gateway Labs will offer local biotech firms direct access to Lilly scientists, team members and executives, as well as exposure to Lilly’s scientific and functional expertise. With over 65,000 sq. ft., the site offers 32 flexibly designed private lab modules, each of which includes lab space for six to eight scientists, office space, and work stations.

"Lilly chose the Bay Area as the location for Lilly Gateway Labs for many reasons, including the ability to tap into the hotbed of biotech innovation already based here," said Julie Gilmore, Ph.D., site head and chief operations officer, Lilly Gateway Labs. "We’re excited to further extend our California footprint because of the supportive scientific environment which enables all aspects of drug discovery."