For a life sciences executive, looking at Europe from outside the continent looks amazingly complex: Despite most European countries being part of the European Union, there seem to be more differences than similarities.

A variety of tax systems and incentives — or different labor law and immigration regulations with countries being in the Schengen area and others outside of it — make it difficult to decide where and how to set up a European structure. (The Schengen Agreement, signed 30 years ago and implemented 20 years ago, allows free movement across 26 member countries without border checks to some 400 million EU citizens, as well as non-EU nationals, businessmen, tourists or other persons legally present in EU territory.)

| Country | Biotechnology | Biotech Therapeutics |

Medtech | Pharma |

|---|---|---|---|---|

| Austria | 94 | 40 | 52 | 15 |

| Belgium | 265 | 50 | 135 | 74 |

| Denmark | 137 | 58 | 71 | 10 |

| Finland | 82 | 14 | 37 | 10 |

| France | 720 | 138 | 160 | 94 |

| Germany | 1,042 | 159 | 572 | 103 |

| Ireland | 65 | 18 | 39 | 11 |

| Israel | 334 | 154 | 545 | 36 |

| Italy | 518 | 59 | 104 | 87 |

| Netherlands | 409 | 86 | 117 | 40 |

| Norway | 120 | 27 | 32 | 8 |

| Spain | 421 | 83 | 80 | 60 |

| Sweden | 408 | 115 | 301 | 41 |

| Switzerland | 346 | 104 | 230 | 47 |

| United Kingdom | 979 | 246 | 275 | 110 |

| BayArea | 380 | 214 | 199 | 13 |

Adding to the complexity is the fact that completely different business cultures exist within Europe, from the Anglo-Saxon free market approach to the Nordic social market model or French-style centralistic planning (not forgetting the existence of the Euro currency block, which doesn’t include all European countries).

On the other hand, Europe offers exciting opportunities for life sciences companies from North America and Asia. Besides being the second largest market for high margin drugs and medical devices thanks to a well-established public healthcare a system, the very large European life sciences industry and the region’s many top-rated universities offer fertile ground for greenfield investments, collaboration and acquisitions.

A New Report

In order to help decision-makers in multinational life sciences companies better understand the complexity of the European Life Sciences Landscape, KPMG Switzerland, in collaboration with Venture Valuation, has released its 2015 Report on “Site Selection for Life Sciences Companies in Europe,” which offers facts and figures for international companies looking to expand, restructure or consolidate their activities in Europe.

| Country | Biotechnology | Medtech | Pharma | Total |

|---|---|---|---|---|

| Belgium | 15,000 | 5,000 | 40,000 | 60,000 |

| France | 11,000 | 40,000 | 95,000 | 146,000 |

| Germany | 37,000 | 100,000 | 110,000 | 247,000 |

| Ireland | 6,000 | 9,000 | 12,000 | 27,000 |

| Netherlands | 8,000 | 9,500 | 9,000 | 26,500 |

| Switzerland | 20,000 | 45,000 | 40,000 | 105,000 |

| United Kingdom | 30,000 | 71,000 | 73,000 | 174,000 |

The report compares seven European countries (Belgium, France, Germany, Netherlands, Ireland, Switzerland and the UK) with strong clusters and/or important attractiveness to foreign direct investors (FDIs) due to how they support life sciences companies in:

- strengthening their capabilities by collaborating with peers and universities for various activities such as R&D, supply chain and marketing through clusters of life sciences companies

- improvingtheir agility to react quickly to changing market environments, client needs, regulations and technologies

- increasing their values by benefiting from tax planning and incentive models.

The report’s key findings:

In total there are roughly 11,000 life sciences companies (biotech, pharma, medtech) across 14 European countries and Israel.

The largest concentration of life sciences companies can be found in Germany, the UK and France. Germany leads in medtech, while the UK is the leader in pharma and in biotherapeutics.

| Country | R&D (% of all) |

Manufacturing (% of all) |

Research on Contract Basis (% of all) |

|---|---|---|---|

| Austria | 91 (54%) | 49 (29%) | 16 (10%) |

| Belgium | 170 (32%) | 308 (59%) | 41 (8%) |

| Denmark | 125 (45%) | 100 (36%) | 28 (10%) |

| Finland | 55 (42%) | 55 (42%) | 21 (16%) |

| France | 523 (47%) | 479 (43%) | 149 (13%) |

| Germany | 696 (37%) | 995 (53%) | 178 (9%) |

| Ireland | 72 (54%) | 68 (51%) | 6 (5%) |

| Israel | 476 (45%) | 485 (45%) | 24 (2%) |

| Italy | 365 (48%) | 418 (54%) | 39 (5%) |

| Netherlands | 273 (42%) | 254 (39%) | 71 (11%) |

| Norway | 85 (45%) | 67 (36%) | 7 (4%) |

| Spain | 329 (51%) | 269 (42%) | 43 (7%) |

| Sweden | 388 (45%) | 411 (48%) | 68 (8%) |

| Switzerland | 323 (45%) | 327 (45%) | 55 (8%) |

| United Kingdom | 652 (40%) | 561 (35%) | 196 (12%) |

| Total | 4,623 (43%) | 4,846 (45%) | 942 (9%) |

| Bay Area | 448 (76%) | 211 (36%) | 22 (4%) |

Switzerland is the leader in workforce in the life sciences industry relative to the size of its population.

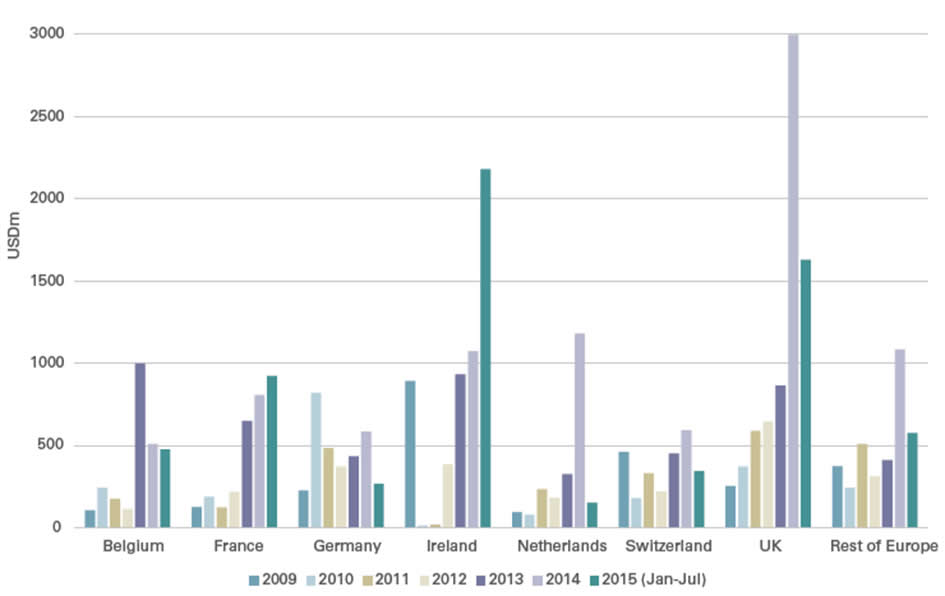

In terms of FDI, the UK clearly leads the group with 37 regional HQs of foreign-owned life sciences multinationals, but other smaller countries such as the Netherlands, Belgium and Switzerland are equally attractive when taking into account the size of their respective economies.

The UK has the largest number of top-ranked universities (8). Compared to the size of the population, however, Switzerland, the Netherlands and Belgium (each with 4) rate better.

Switzerland is rated the most innovative country in Europe followed by Germany, Belgium and the Netherlands. (This finding was reinforced last week by Swiss business school IMD, whose second annual World Talent Report rated Switzerland No. 1 in in developing, attracting and retaining talent to satisfy corporate needs.)

Key business environment factors which influence the agility of a life sciences company include flexibility of labor laws and ease in attracting qualified staff. Here the Anglo-Saxon countries along with Switzerland fare especially well.

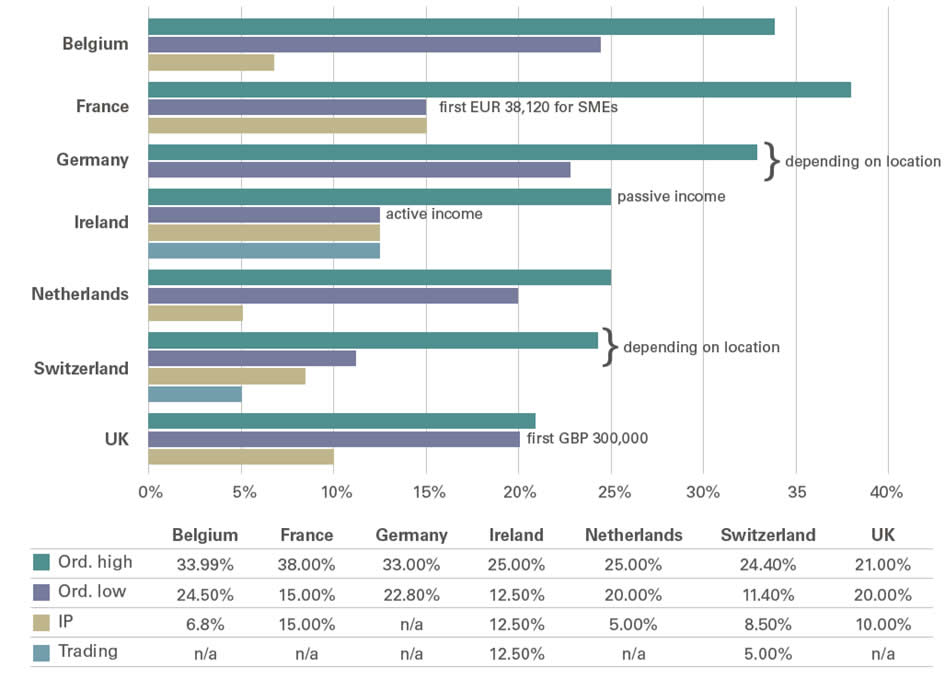

Diligent and forward-looking tax strategies are important tools to increase the value of a life sciences company. Particularly important are tax rates for income generated by intellectual property, as well as incentives for R&D. The countries covered in this report apply various strategies to remain competitive in this field. Ongoing discussions on Base Erosion and Profit Shifting (BEPS) which focus on substance for sustainable tax planning will limit certain tax planning strategies.

Outlook

Going forward the report draws a mixed picture of the outlook for the seven countries:

- The UK and Switzerland currently clearly stand out from the rest of the countries in regards to attractiveness for regional HQs, complex manufacturing and R&D centers. The main challenges for the UK are low productivity, increasing salaries, appreciating currency and political uncertainties. Switzerland’s main challenges are high salaries and uncertainty about immigration.

- Ireland, Belgium and the Netherlands are attractive for regional HQs, manufacturing and certain R&D activities, due to their attractive tax and incentive systems. However, they lack a truly sizable life sciences industry such as Switzerland’s. Ireland, the Netherlands and Belgium will have to prove that they have the capacity to host true value-driving substance such as R&D or complex management or manufacturing operations.

| Country | Global Headquarters of Domestic LS Companies | Main Activities in Addition to HQ Activities | Regioinal Headquarters of Foreign Owned LS Companies | Main Activities in Addition to HQ activities |

|---|---|---|---|---|

| Belgium | 36 | Manufacturing 67% | 23 | Manufacturing 78% |

| France | 112 | R&D/Manufacturing 63% | 25 | Manufacturing 84% |

| Germany | 158 | Manufacturing 77% | 25 | Manufacturing 76% |

| Ireland | 29 | Manufacturing 59% | 6 | Supply / Distribution and Manufacturing 83% |

| Netherlands | 46 | Manufacturing 72% | 17 | Supply / Distribution 82% |

| Switzerland | 97 | Manufacturing 68% | 22 | Supply / Distribution 64% |

| United Kingdom | 146 | Manufacturing 53% | 37 | R&D 54% |

| Total | 624 | Manufacturing 66% | 155 | Supply / Distribution 66% |

| Bay Area | 110 | Manufacturing 49% | 6 | Manufacturing (83%) |

- Germany and France have large life sciences clusters, but their business and tax environments are not flexible enough for many fast-growing overseas life sciences companies.

- Pure tax considerations will not be sustainable in the future. BEPS requirements will force companies to align profits, risks and activities with qualified substance. This might provide for opportunities for countries such as France and Germany, if they are able to offer more flexible business conditions.

- The UK and Switzerland will have to battle to maintain taxes at competitive levels while keeping salaries under control and reducing political uncertainties.

A New Approach

Defining where to set up a European HQ, an acquisition vehicle, an R&D center or a manufacturing plant should be based on a detailed analysis of the value drivers and the goals company leaders want to be achieve by entering or expanding in Europe. While certain projects involving a presence in Europe are focusing on strengthening innovation or gaining market access, others are geared towards improving processes and organizational structure (which can lead, for example, to lower effective tax rates).

The authors of the report suggest first assessing the value drivers with regard to their contribution for general profit generation or for reaching the goals of an expansion project, and then dividing them into key value drivers and secondary value drivers. The different locations in play should then be compared with regard to their capacity to host these key value drivers.

Key value drivers of specific importance for the life sciences industry are research and development, operational excellence, sales and marketing, and manufacturing. Depending on the project, each value driver is differently weighted, and different locations might prove to be ideal for (re)locating these value drivers.

André Guedel, Head Sales and Business Development TAX for KPMG Switzerland, is an economist with extensive experiences in site selection and site promotion. He heads KPMG Switzerland activities for regional HQs of multinational companies in Switzerland, and regularly advises companies on their expansion activities to Europe.