One picture of the US logistics sector shows a healthy automotive corridor leading the way, buttressed by big volumes in port- and border-driven goods movement down south; Chicago’s continuing role as a hub; and the Keystone State living up to its name in connecting multiple regional economies.

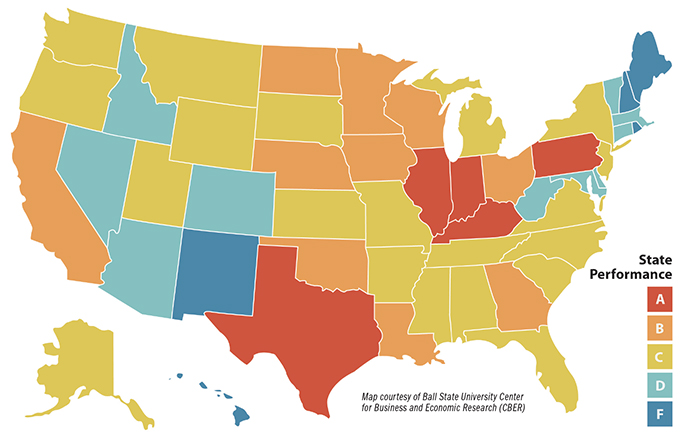

The Center for Business and Economic Research (CBER) at Ball State University each year publishes for Conexus Indiana the Manufacturing & Logistics Report Card for the United States. This year’s edition, released in June, awards “A” grades to only five states: Texas, Illinois, Indiana, Kentucky and Pennsylvania.

The report’s authors use federal statistics such as total logistics industry income as a share of total state income, and logistics employment per capita. Calculations also include commodity flows data by both rail and road, and per-capita expenditure on highway construction.

Like neighboring slices of pie, Illinois, Indiana and Kentucky fan out across a region that incorporates the Mississippi River and the I-75 automotive corridor. It’s also likely no coincidence that all the A-level states are home to new or expanding Amazon fulfillment centers — sometimes several.

While the A students get the glory, corporates are wise to also look at states on an upward trend. The CBER report notes the following improvements (though some might not yet be high enough to brag about):

California: C+ to a B-

Colorado: D to D+

Iowa: B to B+

Oklahoma: C to B-

Oregon: D+ to C-

Vermont: F to D-

“The movement of goods is of central importance to the production of goods,” the CBER report notes. “Without a robust logistics industry, manufacturing and commodity production will not occur. Logistics comprises not merely the capacity to move goods, but to store inventory and manage the distribution and processing of manufactured goods. Logistics firms depend upon many of the same factors as manufacturing firms in their location decision, but there is a more complex interplay between local conditions and the existing or planned transportation networks of roads, railroads, waterways, and airports.”

Sign Us Up

Switch a couple letters around and you move from the CBER to CBRE, which in June released its own snapshot of warehouse pre-commitment by tenants nationwide — currently at its highest since 2000.

“Almost half of the 167 million sq. ft. [15.5 million sq. m.] of US warehouse space currently under construction — 72 million sq. ft. [6.7 million sq. m.] — is already pre-committed to tenants, primarily e-commerce, third-party logistics and retail users,” said the CBRE Group report. “In addition, the current ratio of space under construction that is pre-leased to occupiers — 43 percent — exceeds the 17-year average of 38 percent. That signals healthy momentum for the market.”

At the city level, several metros at the top are in states topping CBER’s scorecard: As of Q1 2017, “Denver leads the way with 70.3 percent of its under-construction space pre-committed,” says the CBRE report, “followed by Kansas City (54 percent), Chicago (51.3 percent), Indianapolis (50.6 percent) and New Jersey (43.3 percent).”

Where’s the new development coming? JLL reported in June too: “Adding the new deliveries from the past five years with the current construction pipeline, the US industrial market will add nearly 1 billion sq. ft. [92.9 million sq. m.] to its inventory by 2018,” said JLL. “Dallas, Inland Empire [Southern California], Philadelphia, Denver and Atlanta were the top five markets accounting for more than half of the new development starts in the first quarter.”

“Vacancies are at historic lows and in some markets, as low as two percent or less,” said Craig Meyer, president of JLL’s Industrial group, Americas. “Coupled with broad rental growth in some markets as high as double digits year-over-year, 2017 is already shaping up to be another great year for industrial real estate. There is also an estimated 247 million square feet [22.9 million sq. m.] of new industrial space slated for delivery, a 10-year high. These figures show the market is on fire today for industrial property owners, but in some markets it poses unique challenges for companies searching for industrial space.”