|

Since January 2015, Site Selection’s Conway Projects Database has qualified 58 major data center investments in the Europe’s “FLAP-D” markets: Frankfurt, London, Amsterdam, Paris and Dublin.

Those markets have always attracted the lion’s share of data center investment in Europe. But a new report from Morningstar DBRS says secondary markets are beginning to assert themselves as data center developers confront such issues as power and land availability, as well as regulatory measures designed to limit further data center development:

As cloud adoption, internet-of-things, and the artificial intelligence (AI) industries continue to grow, so do the data storage and computing needs and the resulting demand for data centers. The increasing demand for data centers and the favorable market fundamentals have, in turn, spurred investor interest in this asset type and resulted in more capacity being delivered. Nevertheless, the delivery of data center assets is subject to various supply constraints such as land and power availability. Even upon securing sufficient power, which can prove to be a major hurdle due to how much energy data centers consume, the construction of the facilities takes considerable amount of time and upfront capital investment, not to mention the specialized knowledge required to develop and operate these assets.

Regardless, the industry continues to grow. According to a report published by Grand View Research, the global data center market was valued at US$194.81 billion in 2022 and is projected to grow at a compounded annual growth rate (CAGR) of 10.9% between 2023 and 2030.

Data centers have been subject to significant interest especially from institutional investors over the recent years, which is expected to continue at least over the short term as the sector continues to exhibit relatively low vacancy rates and increasing rental rates driven by the above-mentioned supply restraints and high barriers to entry. A CBRE report suggests that 97% of the respondents to its 2024 Global Data Center Investor Intentions Survey, which include some of the world’s largest institutional real estate investors, plan to increase their capital deployment in the data center sector this year. The survey also found that 92% of the respondents are allocating more than US$100 million to the data center sector, 44% are allocating more than US$500 million, and 17% are allocating more than US$2 billion in 2024, up from 85%, 32%, and 8%, respectively, in 2023.

Morningstar DBRS makes note of the major wholesale and retail data center developers such as Digital Realty (and its subsidiary Interxion), CyrusOne, QTS Data Centers, Equinix, NTT Global Data Centers and CloudHQ. Then it turns its attention to the hyperscalers who not only lease from some of those developers but build their own facilities, noting the recently announced plans from Microsoft and OpenAI to develop a $100 billion data center project by 2028 to house the AI supercomputer Stargate. Grand View Research reports the hyperscale segment alone is expected to register a CAGR of more than 13% between 2023 and 2030.

The report then summarizes key aspects such as lease and service level agreements (SLAs), power usage effectiveness (PUE), redundancy and connectivity (i.e. power nodes and subsea cables), making note of a relevant detail when it comes to the lifespan of those cables:

The typical lifespan of a subsea cable is estimated around 25 years. As these cables age, they become costlier to maintain and they are typically retired before the 25-year mark depending on the trade-off between repair costs and how much revenue the cable continues to generate. Therefore, an analysis of where a data center asset is located in relation to subsea cables might prove to be a dynamic assessment depending on where the nearby cables are in their lifespan and whether there are subsea cables in close proximity that are being developed and scheduled to come online in the near future.

Then the Morningstar report delves into the markets themselves.

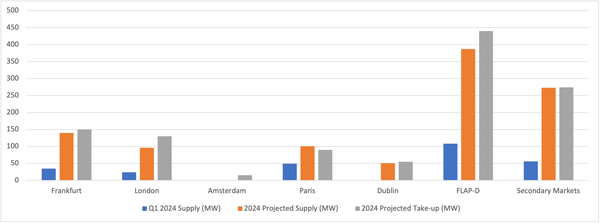

The biggest data center markets in the EMEA region in terms of live IT power and foreseeable delivery on the pipeline are currently Frankfurt, London, Amsterdam, Paris, and Dublin, also known as the FLAP-D markets. According to CBRE’s reporting on Q1 2024 figures for Europe data centers, over the first quarter of 2024, take-up in the FLAP-D markets (111 MW) exceeded the new supply in these markets (108 MW). This imbalance is expected to hold for 2024 based on CBRE’s projections, which indicate 440 MW of take-up and 387 MW of new supply for the year. This would make 2024 the third consecutive year reporting higher take-up than new supply in these markets with the continuing strong demand driven primarily by hyperscalers. The year 2023 saw a take-up of 511 MW and supply of 467 MW. CBRE expects the vacancy rate in these five markets to decline to 8.1% by the end of 2024.

Here are summaries of those five markets based on data Morningstar DBRS collected from such sources as CBRE and Data Center Journal:

Frankfurt: 64 data centers operated by 43 providers; “CBRE notes Frankfurt is expected to have its greatest year of annual take-up (150 MW), which will drive vacancy down to below 5%, the lowest of any market tracked by CBRE.”

London: 104 data centers operated by 56 providers; “Slough, located in London’s western corridor, remains one of the biggest data center clusters in the region with demand driven primarily by hyperscalers. CBRE reports the market is likely to experience growth in demand as start-ups, enterprise, and GPU-as-a-service providers look to take up data center space, which can meet their AI-computing needs in the years to come. This may result in providers looking outside of Greater London as securing the power necessary for a data center becomes increasingly more difficult in the city.”

Amsterdam: 52 data centers operated by 36 providers; while the completion in 2025 of an power substation should bode well for future development, “Amsterdam is the only FLAP-D market that will see no new supply coming online in 2024, based on CBRE’s projections. While Amsterdam remains one of the world’s top connectivity hubs and Europe’s third-largest data center market, power availability restraints and strict regulations around data centers dampened new supply in the region and new supply should be limited in the short-term.”

Paris: 71 data centers operated by 46 providers; As with most FLAP-D markets there are regulatory challenges to building data centers in Paris, with zoning restrictions for 2024 Olympics becoming a further complication, and it is becoming increasingly difficult to secure land and power necessary for data centers particularly in the north. Regardless, Paris is projected to exhibit the second-largest new supply of data center capacity in 2024 among the FLAP-D markets. Hyperscalers extended their presence considerably in the region over the past year, especially in South Paris and demand is expected to remain high in the foreseeable future.

Dublin: 19 data centers in Dublin operated by 13 providers; “The supply restraints are likely to continue over the short term as providers have difficulty securing power from the country’s electric grid operator, EirGrid. EirGrid imposed a de facto moratorium on further new data center development in the greater Dublin area until 2028 due to the strain these assets represent to the country’s power grid and capacity concerns. We understand EirGrid reviews data center applications requesting to connect to the grid on a case-by-case basis.”

Activity in these hubs continues apace, including Digital Realty’s $200 million acquisition in July of a key asset in Slough that it described as “an established hub for a community of 150+ customers, including a broad array of connectivity providers, technology companies, and financial services firms, utilizing over 2,000 cross connects.” The company maintains six data center campuses in greater London.

Meanwhile, secondary markets in Europe are benefiting from the high demand, says Morningstar DBRS, citing CBRE’s Q1 2024 report indicating a projected new supply of 273 MW for secondary markets in 2024. CBRE’s secondary markets category includes Berlin, Brussels, Madrid, Milan, Munich, Oslo, Stockholm, Warsaw, Vienna, and Zurich. But other markets are attracting investment too, including a second data center in Barcelona from Equinix.

CBRE also reports Berlin, Madrid, Milan, Oslo, and Warsaw are expected to account for almost 90% of the expected 274 MW of take-up in 2024 and eight of the 10 secondary markets tracked, including Berlin and Milan, are expected to show double-digit supply growth in 2024. CBRE projects vacancy rate in secondary markets to average 16.6% by year-end.

Challenges & Trends

The report then examines the sector’s biggest issues, including sustainability.

As hinted above, the biggest challenges to the delivery of data centers will come from securing sufficient power and necessary permissions to construct new facilities. The amount of power data centers use can represent a significant strain on the national power grid. Figures from the Republic of Ireland’s Central Statistics Office (CSO) suggest data centers in the country accounted for almost 17.6% of the national electricity consumption in 2022. It comes as no surprise then that delivery of new data centers in the most populated city in the country (Dublin) became increasingly more difficult over the years. Data centers also consume significant amounts of water to operate and maintain server temperatures, presenting another challenge to sustainability.

However, key players have signed on to the Climate Neutral Data Centre Pact (CNDCP), says the report, an initiative developed by the industry with the support of the European Commission that lays out climate targets to achieve in 2025 and 2030. Signatories include AWS, CyrusOne, DATA4, EdgeConneX, Equinix, Google, Irideos, Microsoft, and NTT. Among the goals:

Climate Neutral Data Center Targets

| Working Group |

Targets

|

| |

|

| Energy Efficiency |

• By January 1, 2025, new data centers operating at total capacity in cool climates will meet an annual PUE target of 1.3 and 1.4 for new data centers running at full meeting capacity in warm temperatures.

• Existing data centers will achieve these same targets by January 1, 2030.

• These targets apply to all data centers larger than 50KW of maximum IT power demand.

• In recognition of the European Commission’s interest in creating a new efficiency metric, trade associations will work with the appropriate agencies or organizations toward creating a new data center efficiency metric. Once defined, trade associations will consider setting a 2030 goal based on this metric. |

| |

|

| Clean Energy |

• Data center electricity demand will be matched by 75% renewable energy or hourly carbon-free energy by December 31, 2025 and 100% by December 31, 2030. |

| |

|

| Water |

• By 2022, data center operators will set an annual target for water usage effectiveness (WUE) or another water conservation metric, which new data centers will meet by 2025 and existing data centers by 2030.

• The water metric target may vary depending on the data center design specification. |

| |

|

| Circular Economy |

• Data centers will set a high bar for circular economy practices and assess for reuse, repair, or recycling 100% of their used server equipment.

• Data center operators will increase the number of server materials repaired or reused and create a target percentage for repair and reuse by 2025. |

Source: Climate Neutral Data Center (https://www.climateneutraldatacentre.net/working-groups/#).

The sustainability profile of a given location and its access to renewable energy should prove a competitive advantage, the report concludes. Among other observations:

The data center market is still a supply-restrained market with significant demand for extra capacity, mostly driven by hyperscalers. As securing power and permits to deliver new data centers becomes increasingly more difficult in FLAP-D markets, secondary markets will be in an advantageous position to benefit from this demand. Locations within those secondary markets that provide good connectivity (i.e., low latency to major markets, proximity to key fiber routes) and access to reliable, renewable energy will stand to benefit the most.

As for credit analysis:

Understanding the data center market and evaluating these assets from a credit perspective requires understanding various aspects of the industry and this asset type, such as key market participants, SLAs, what differentiates an attractive asset from an average one, and a knowledge of primary versus secondary markets, just to name a few …

In order to fully capture the risks of a transaction secured by this asset type, we will continue to follow industry progress and the regulatory landscape in addition to analyzing the specific strengths and weaknesses of the collateral with respect to power availability, use of renewable energy, connectivity, redundancy, energy efficiency, and the track record of its operator amongst other factors.

.jpg) A second data center in Barcelona from Equinix encapsulates two EMEA trends: locating in markets outside the traditional FLAP-D metros and connecting to major international subsea cables.

A second data center in Barcelona from Equinix encapsulates two EMEA trends: locating in markets outside the traditional FLAP-D metros and connecting to major international subsea cables.

Rendering courtesy of Equinix

|