|

The second annual edition of Site Selection’s America’s Best Counties was released this week, based on project tallies and associated capital investment and job creation between January 2023 and March 2024 as tracked by Conway Data’s proprietary Conway Projects Database.

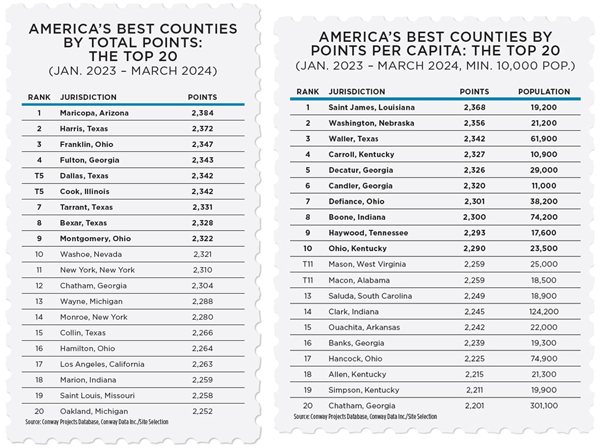

As with our annual Governor’s Cups honors, we recognized two sets of high achievers: those winning the most projects, capital investment and job creation outright, and those winning the most per capita. Maricopa County, Arizona; Harris County, Texas; and Franklin County, Ohio, took top honors by total points. On a per-capita basis, Saint James Parish, Louisiana, was No. 1, followed by Washington County, Nebraska, and Waller County, Texas (part of the same Houston metro as Harris County).

Click image to enlarge.

To no one’s surprise, five of the top 20 overall were in Texas. Ohio claimed three, while Georgia and Michigan nabbed two apiece. In the per capita category, Georgia and Kentucky each claimed four of the top 20 counties. Indiana had two and so did Ohio, both of them (Defiance and Hancock) in the state’s northwest corner near Toledo.

A closer look at our full data sets reveals further findings across the 798 counties we considered that had at least 10,000 in population and at least one qualified facility investment project during the 15-month time period. For example: Which states had the most counties among those 798 and therefore might be viewed as literally spreading the wealth? Here are the top 10 and ties:

| State |

Project Count |

| |

|

| Texas |

58 |

| Georgia |

55 |

| Ohio |

51 |

| North Carolina |

40 |

| Indiana |

39 |

| Kentucky |

34 |

| Virginia |

32 |

| Florida |

28 |

| New York |

27 |

| Tennessee |

27 |

| Illinois |

27 |

These states are OLI (outside looking in) but have robust numbers nonetheless:

| State |

Project Count |

| |

|

| Pennsylvania |

26 |

| Michigan |

25 |

| Louisiana |

25 |

| Alabama |

25 |

| California |

24 |

A further question worth asking: Which counties performed best across both the cumulative and per-capita categories?

In this case, a county that placed No. 12 in one chart and No. 20 in the other jumps to the top: Chatham County, Georgia, otherwise known as the Savannah metro area. Next comes the Houston-area county of Waller, followed by Clark County, Indiana, part of the Louisville metro area whose main city — Jeffersonville — you can walk or bike to from downtown Louisville across the Big Four Bridge.

If the 798 counties are sorted by capital investment, among the top attractors is Cameron County, Texas (Brownsville), whose major projects include NextDecade’s LNG complex. For next year’s scorecard the area will be able to count a $3 billion, 1,000-job hydrogen-powered clean fuels manufacturing facility at the Port of Brownsville from Element Fuels that was announced in June.

Sorted by job creation, No. 1 Maricopa County is still No. 1 with over 14,000 jobs, including thousands associated with semiconductor-driven project activity. Second place is Cook County, Illinois, followed by Chatham County, Georgia; Los Angeles County, California; and Dallas County, Texas.

The 10,000-person watermark is a figure we’ve used before in rankings to establish a workforce baseline. But if we let into our rankings counties with fewer people, new places pop into position: Storey County, Nevada, for example, located east of Reno, has only around 4,200 people but has attracted five projects, including two major metals industry investments and a $358 million data center from Novva. Since our March cutoff, the county has drawn two more projects, including another data center from Vantage that’s bringing a $730 million investment.

Other lower-echelon populations with higher-echelon performance include Coffey County, Kansas (8,000 people) and Turner County, South Dakota (9,000).

Returning to our original rankings, it’s also worth asking: What are the major projects driving these counties to the top?

In Maricopa County, multiple investments from LG Energy in Queen Creek lead the way, joined by projects from Amkor Technology, Next Era/Linde and Desert Studios.

Harris County’s projects include investments from Borealis/TotalEnergies and Bayport Polymers; Ceva Logistics; Power Electronics USA; Calpine Corp.; and Sumika Semiconductor Materials.

Franklin County (Greater Columbus) is in the headlines for its proximity to the huge Intel semiconductor complex rising in nearby Licking County. But the biggest projects landing in Franklin during the prescribed time period are all data centers from QTS, CyrusOne and DBT Data.

Broken down by sub-category, the per-capita rankings show Dakota County, Nebraska, having the most projects per capita, with 10 qualifying investments in a community of 21,000. Most of them are in South Sioux City, including a $12 million, 12-job investment from Heartland Counseling Services; a $14 million, 70-job expansion from window and door manufacturer GWD; and a $3 million, 15-job project from Washington-based Scratch and Peck LLC, which makes organic poultry feed.

With more than 1,200 project-driven new jobs in a region of 19,000 people, our No. 1 per-capita county St. James Parish in Louisiana is No. 1 by jobs per capita as well.

Among the per-capita leaders, as described by Mark Arend in the July issue’s cover story, Saint James Parish is welcoming investments from FG LA LLC (Part of Formosa Plastics Group), Louisiana Sugar Refining and Associated Marine Equipment to Louisiana. Washington County’s biggest projects in the community that’s part of the Omaha-Council Bluffs metro area come from Novozymes, Perfect Day, Dollar General, Stewart Stainless Supply and Nebraska-Iowa Supply Company — all in the town of Blair. Waller County, Texas, meanwhile, has landed projects in its signature town of Brookshire from Waaree Energies, Elin Eletrik, Mayekawa Manufacturing, Quality Packaging Systems and Armstrong Supply Chain Solutions.

Wanna check our work? One source of comparison (or at least complementary data) is the Economic Development Capacity Index (EDCI) developed by Argonne National Laboratory with the support of the U.S. Economic Development Administration. It provides a data-driven estimation of capacity, including relative strengths and potential areas for growth or maturation across five capacity areas — human capital, financial, industry, infrastructure, and institutions and partnerships — composed of 53 unique indicators.

Among our top-ranked counties, Maricopa County, Arizona, has a rank of “high” or “elevated” in four of the five categories. St. James Parish, Louisiana, is elevated or moderate (close to the national average) in all five. Chatham County, Georgia, is high in infrastructure, elevated in industry and moderate in all other categories.

The tool includes a comparison viewer that allows the user to examine EDCI scores for two different counties side by side. — Adam Bruns

.JPG)

Intel CEO Pat Gelsinger speaks on March 20, 2024, at Intel’s Ocotillo Campus in Chandler, Arizona, in Maricopa County, where earlier that day the company and the U.S. Department of Commerce signed a non-binding preliminary memorandum of terms for up to $8.5 billion in direct funding to Intel for commercial semiconductor projects to support more than $100 billion in investments from Intel.

|