ob retention efforts are important on different levels, not the least of which is that job loss is devastating for both individuals and communities. While it may be too early to evaluate the effectiveness of certain job retention programs, the states’ efforts have provided policies that may affect positive change.

To put the issue in perspective, taxadvantagegroup maintains a database of federal and state incentive programs, IncentivePro. To date, the database documents over 3,200 programs, approximately 145 of which address job retention. Eighty-five percent of job retention programs support the following broad policy issues:

• work force development – 51 percent,

• capital availability – 19 percent, and

• state-funded public infrastructure – 15 percent.

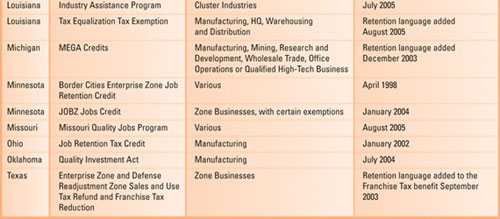

Fifteen percent were enacted to support a specific company or specific industry. This article will focus on those targeted retention programs (“Targeted Programs”).

While retention is a broad based ideal and related programs are varied, current Targeted Programs reflect five general tendencies:

1. Manufacturing Industry Focus

2. Trial and Error

3. Significant Job Retention Requirement

4. Modernization Requirement

5. Highly Discretionary

|