For more than three decades FDI poured into Asia. China, India and the ASEAN countries all experienced years of rapid economic growth, at times reaching double digits. This economic miracle elevated more than 1 billion people out of poverty. Today Asia is more than the world’s factory; it is also the world’s largest consumer market and an increasing source of investment to the rest of the world.

But times are changing. Black and gray swan events and the business disruption they bring are more frequent and increasingly impactful to business, particularly in Asia. Rising uncertainty has brought risk management to the forefront of trade and investment decisions for both private companies and economic development organizations. Whether the risk is to national security, the economy, supply chain, or human resources, these risks are being closely analyzed and carefully considered before investment decisions are made.

Over the past decade as isolationism and nationalism have overtaken globalization and multilateralism as the defining trend, many countries have moved toward autocratic leadership and focused on being more self-sufficient and less dependent on global trade. Writers such as Michael O’Sullivan in his book, “The Levelling: What’s Next After Globalisation,” trumpet that globalization is dead or may be dying. But, from a trade and investment perspective, the pendulum is only swinging back toward a more balanced approach to evaluating all of the factors, including risk, in location decisions.

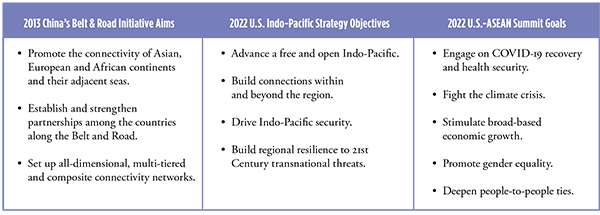

More governments are actively engaging in both multilateral and bilateral trade negotiations — especially in Asia — than they have in the recent past. The ratification of the Regional Comprehensive Economic Cooperation Partnership (RCEP) in November 2020 encompassing 15 Asian economies; the Biden Administration’s launch of the U.S. Indo-Pacific Strategy in February of 2022; and the recently announced U.S.-ASEAN Special Summit to be held in May prior to the APEC Summit hosted by Thailand in November are all relevant examples of renewed government focus on Asia and the continued importance of cross-border trade and investment.

The United States’ recent activities are clearly an effort to balance China’s near-decade-long promotion of its vision of economic colonialism to its Asian neighbors and those beyond, epitomized by its geostrategic Belt and Road Initiative.

Almost every company is being buffeted by significant headwinds from the Russia-Ukraine war; rapidly increasing inflation; supply chain disruptions; and challenges attracting and retaining qualified talent.

Evaluating and mitigating risks of all types has become a driving consideration of multinational corporations as they evaluate their investment and site selection decisions. This increasing emphasis on risk evaluation and mitigation is pulling the investment pendulum away from globalization and toward regionalism. Manufacturers are no longer building a single large facility for global supply or concentrating their manufacturing operations in any one country. Instead, they are rebalancing their global manufacturing footprints and investing in multiple, more automated facilities in locations closer to their customers. Multiple global operations ensure resiliency in the supply chain and mitigate the impact of unforeseen disruptions.

Corporate headquarters decisions are being driven less by tax considerations than by a more balanced combination of factors including regulatory and security risks. In Asia this is most apparent in the current spate of corporate relocations from Hong Kong to Singapore following democracy protests and Beijing’s heavy-handed reaction.

Corporate headquarters decisions are being driven less by tax considerations than by a more balanced combination of factors including regulatory and security risks.

Economic development organizations also need to consider risk when prospecting for investors. For many years China has been a key target for global EDOs for both export promotion and investment attraction. While China is still investing globally, economic, geo-political and security concerns are influencing EDOs’ strategic considerations. Chinese companies too are being more conservative in their investment decisions. The strained relations between the U.S. and China have postponed many decisions on new investments, despite the continued strong desire by Chinese companies to invest into the U.S. While the world’s second largest economy cannot and should not be ignored, EDOs are developing programs for trade promotion and investment attraction strategies focusing on alternative target geographies like ASEAN and India and increasing their investment promotion efforts and activities in traditional targets of Japan, Korea and Taiwan.

Despite global uncertainty and risk, the economies in Asia will continue to develop and grow and must be part of any company’s or EDO’s strategy. Consumers in Asia will be an increasingly important market for global exporters and a driver for manufacturing investment. As companies reconfigure their supply chains to mitigate risk and be closer to consumers, we expect to see a post-pandemic surge in investment to supply regional demand. There will be an increased emphasis on locating projects in China for China, in ASEAN for ASEAN, in Japan and Korea for Northeast Asia and in India for India.

Asian companies are increasingly looking at outward investments to take advantage of growth opportunities and will account for a larger share of global FDI flows. Investment decisions related to Asia will be influenced by a renewed emphasis on regionalism as a way for companies to de-risk their location decisions and ensure a more resilient supply chain and business continuity. Risk as part of any investment decision will be a key criterion, and global companies will need to ensure they have not only analyzed the cost and operational conditions but evaluated their investment plans through the lens of risk in today’s uncertain world.

John J. Evans, (john.evans@tractus-asia.com) is co-founder and managing director of Tractus Asia Ltd. (www.tractus-asia.com) a 25-year-old pan-Asian strategic advisory firm providing advice and assistance to multinational companies and governments on investing in and growing business in Asia.

John J. Evans, (john.evans@tractus-asia.com) is co-founder and managing director of Tractus Asia Ltd. (www.tractus-asia.com) a 25-year-old pan-Asian strategic advisory firm providing advice and assistance to multinational companies and governments on investing in and growing business in Asia.