As states, communities and companies across the U.S. scramble for a slice of the $52.7 billion federal CHIPS (Creating Helpful Incentives to Produce Semiconductors) and Science Act pie, two things already are certain: America is undergoing a resurgence in semiconductor manufacturing; and there will be winners and losers.

Recent reports shed light on U.S. chipmaking trends. The Semiconductor Industry Association documented that, from May 2020 to January 2023, $187 billion in new semiconductor fabrication plants were announced nationwide. During that same period, another $9.64 billion in supplier projects were unveiled. Together, these projects stand to create over 40,000 new high-tech jobs across the country, according to SIA.

Micron says its leading-edge memory fab in Upstate New York will create nearly 50,000 New York jobs over more than 20 years.

Rendering courtesy of Micron

This same report revealed something else: a dense concentration of the largest of these projects in just a handful of markets. Most notably, this includes $60 billion worth of new fabs in Greater Phoenix; $15 billion in Boise, Idaho; $20 billion in Upstate New York (expandable to $100 billion); $20 billion in New Albany, Ohio (expandable to $100 billion); and $55.6 billion in Texas, mostly around Austin and Dallas.

Can other locations compete? Moscow, Idaho-based Lightcast studied this situation and concluded that if the U.S. is to double its chip output from 12% to 24% of all global production, the country will have to produce 236,878 new high-tech workers who are skilled in the complex demands of semiconductor manufacturing.

Want your share of the $52.7 billion in federal funding? Whether you are a company or an area, the answer is clear: You better get busy producing the workers.

That is easier said than done, as a lot of places are learning. The Boyd Company Inc., a national site selection consulting firm based in Princeton, New Jersey, identified 30 high-tech corridors capable of competing for these coveted projects and the government’s largesse.

“We are totally based in the Rochester area. We looked at other areas in 2017. That is when we made a conscious decision to double down and expand here.” — Rick Plympton, CEO, Optimax Systems

Here is Boyd’s ranking of the top 30 high-tech corridors based on projected annual operating costs for employing 500 workers in a 350,000-sq.-ft. precision factory:

| High Tech Corridor | Total Annual Operating Costs |

|---|---|

| Bay Area Route 101 Corridor | $53,585,603 |

| Los Angeles I-405 Corridor | $50,919,976 |

| Long Island Expressway Corridor | $49,593,115 |

| San Diego I-5 Corridor | $49,009,189 |

| Boston Route 128 Corridor | $48,919,946 |

| Seattle I-90 Corridor | $48,626,376 |

| Maryland I-270 Corridor | $48,347,357 |

| Inland Empire I-215 Corridor | $48,281,921 |

| New Jersey Route 1 Corridor | $47,944,265 |

| Dulles Technology Corridor | $46,447,842 |

| Sacramento Highway 50 Corridor | $46,081,679 |

| Portland Sunset Highway Corridor | $45,999,331 |

| Denver Highway 36 Corridor | $45,685,444 |

| Northern Virginia I-66 Corridor | $45,582,039 |

| Philadelphia Route 202 Corridor | $45,439,211 |

| Connecticut I-95 Corridor | $45,248,875 |

| Southern Nevada I-515 Corridor | $45,045,350 |

| Minneapolis I-94 Corridor | $43,856,022 |

| South Florida I-95 Corridor | $43,636,588 |

| Michigan I-96 Corridor | $43,153,886 |

| Phoenix Loop 101 Corridor | $43,104,376 |

| Michigan I-94 Corridor | $43,041,508 |

| Columbus Ohio I-70 Corridor | $42,765,283 |

| Upstate New York I-90 Corridor | $42,760,199 |

| Central Florida I-4 Corridor | $42,730,971 |

| Chicago I-90 Corridor | $42,672,475 |

| Dallas Telecom Corridor | $41,513,892 |

| Indianapolis Keystone Parkway Corridor | $40,804,485 |

| Atlanta I-20 Corridor | $40,739,745 |

| Central Texas SH 130 Corridor | $39,507,526 |

Source: The Boyd Company Inc.

Costs, Talent Pool Matter to Chipmakers

As the list illustrates, the places winning the biggest projects in the past three years all rank among the 10 least expensive locations. They also score highly on talent.

“Currently, site-seeking companies want to access the greatest labor market and workforce assets possible amid today’s historic labor shortages brought on by the pandemic’s Great Resignation,” says John Boyd Jr., principal of The Boyd Company. “Companies also want to be proximate to major infrastructure, transportation hubs, centers of talent in-migration and hubs of support services — but also in locations that offer affordable operating cost structures.”

All these factors came into play when Boise-based Micron announced in October 2022 that it will initially invest $20 billion and eventually up to $100 billion to build a series of fabrication plants in the 1,300-acre White Pine Commerce Park in Clay County near Syracuse in Upstate New York. Upon completion, it will be the largest chipmaking campus in America and employ over 9,000 workers.

How did we get to this point, and what will it take for other locations in America to compete for these high-value projects and the jobs that go with them? For answers, we turned to some advanced manufacturing leaders based in Greater Rochester, New York, just 90 minutes from the Micron site.

Rochester Stakes its Claim to Chips Supply Chain

“Semiconductor manufacturing is coming back to the region,” says Scott Balaguer, vice president of business development for Edwards Vacuum, which is building a $319 million facility in Genesee County, New York, to serve the semiconductor factories of the future. “We supply equipment to all the integrated circuit manufacturers around the world. We have a couple big factories that produce these large dry pumps in China and Korea. Getting this new factory up and running in New York was critical.”

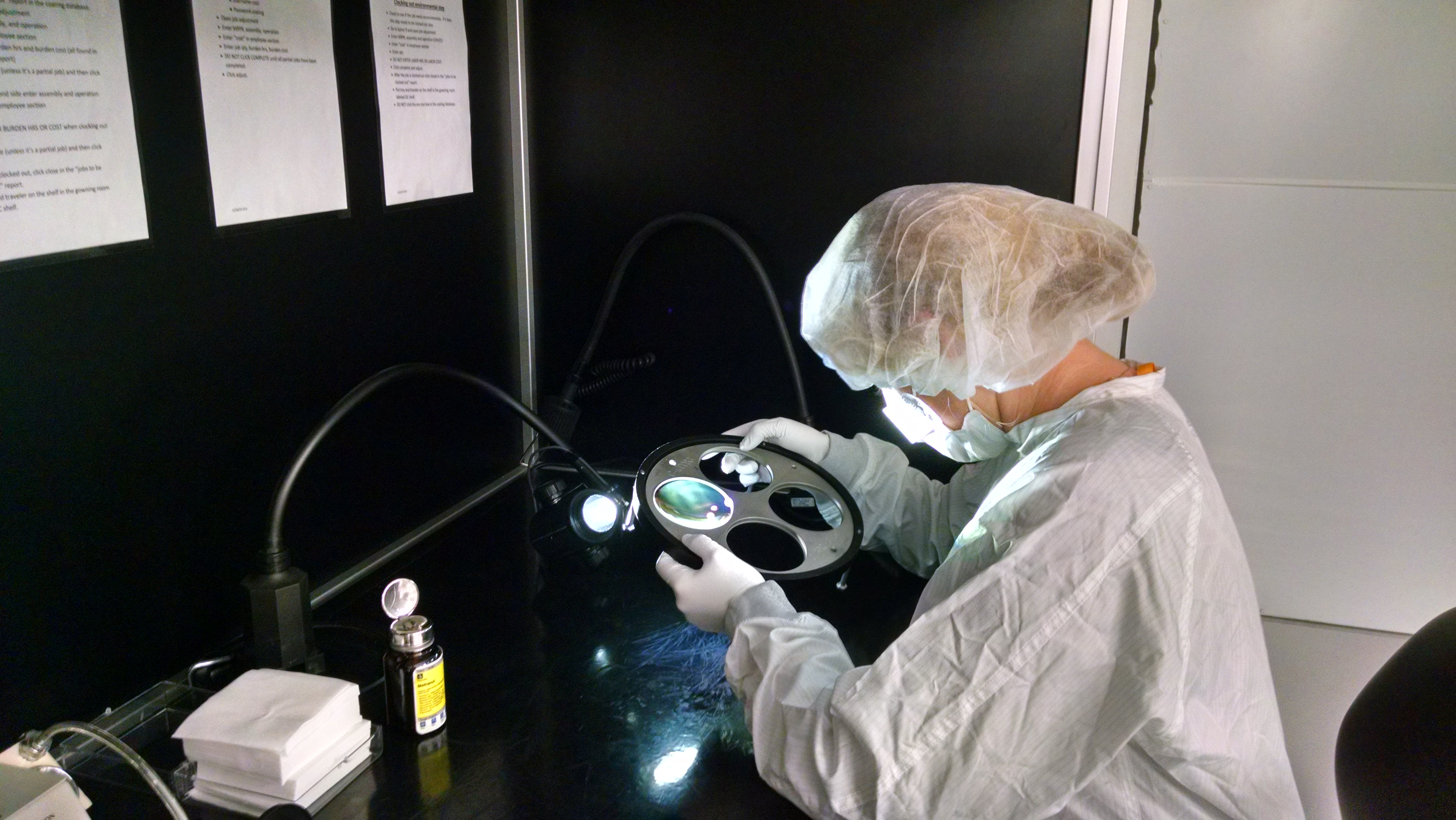

A cleanroom worker inside the main campus of Optimax Systems in Ontario, New York.

Photo courtesy of Optimax Systems

Edwards makes the dry pump technology that enables chipmakers to maintain the cleanroom environment essential to producing high-precision semiconductors. The company opened a new 150-job manufacturing facility in Asan City in Chungcheongnam-do province, South Korea, last June, as well as a cryopump facility in Haverhill, Massachusetts, just north of Boston, last year. Edwards’ parent company Atlas Copco Group last year also acquired Hudson Valley–based Ceres Technologies, a manufacturer and designer of gas and vapor delivery equipment for the semiconductor industry, which will operate under the Edwards brand.

Balaguer says Edwards Vacuum selected Greater Rochester for this new 600-job plant for several reasons.

“We needed to bring this industry back to the U.S.,” he says. “We were shipping heavy equipment from Korea to the U.S., and that is too costly; nor does it align with our goal of reducing our carbon footprint. We were so impressed with the workforce and the opportunity to find great labor here. Everybody at Greater Rochester Enterprise and Genesee County has been so willing to help us. It has been beyond what we saw elsewhere. Plus, we did not want to drive this factory with fossil fuel. The power supply to the site aligns with our carbon reduction goals as a company.”

The project is being built on a site called STAMP – the Science Technology and Advanced Manufacturing Park. The announcement by the UK-based Edwards came one month after the big Micron deal near Syracuse.

“We did our due diligence, that’s for sure,” says Balaguer. “We took a road trip and looked at eight to 10 sites in New York, Ohio and Michigan. We narrowed it down to STAMP, a 1,500-acre, shovel-ready site that has been ready for development for a long time. Electricity comes from hydroelectric power from Niagara Falls, making this an ideal site for our facility.”

“Micron has already had a significant impact on Genesee County with Edwards Vacuum announcing a big project here. Micron will build out a semiconductor supply chain throughout New York.” — Matt Hurlbutt, President & CEO, Greater Rochester Enterprise

When asked what role CHIPS Act funding played, he said: “The impact of that bill on Edwards Vacuum is significant. The financial opportunities we agreed to with New York are quite abundant and important. We will apply to the U.S. Commerce Department to get our fair share of the $52 billion — about $160 per person in the U.S. — that is out there.”

Overcoming Labor Shortage is Key

Confirming the assessment of Lightcast, Balaguer says, “There is a shortage of labor in this industry. The competition for workers is keen. We spent a couple of weeks in Buffalo meeting with people at the colleges and universities there. We will also need people coming from the vocational schools and the trades. It is not just the new college graduate that we need.”

Balaguer says the Micron deal did not influence his company’s decision. “We looked at the White Pine Commerce Park tract as a potential site,” he says. “It was just too big, and it required too much excavation. But is it a bonus that Micron selected it? Big time.”

The Edwards project is moving forward briskly, he adds. “We have selected a developer,” says Balaguer. “We will be there with a bulldozer and a shovel very soon. The new plant will be up and running by early 2025 if not sooner.”

Rick Plympton, CEO of Optimax Systems in Ontario, New York, about 15 miles east of Rochester, says that his own firm has found success in precision optics manufacturing for many of the same reasons that are propelling the semiconductor sector in Upstate New York.

“We have less than 500 employees, and we have averaged 25% revenue growth for the past 30 years,” he says. “We hired 100 new employees last year, and in 2018, we doubled our factory size to 120,000 square feet.”

In 2022, Optimax announced plans to invest $20 million and create 50 new jobs as part of a business expansion in Wayne County in Greater Rochester.

“We are totally based in the Rochester area,” says Plympton. “We looked at other areas in 2017. That is when we made a conscious decision to double down and expand here.”

He says other businesses should consider the same move. “Compared to Boston and the San Francisco Bay Area, Rochester is much more affordable,” he notes. “The Finger Lakes Region is a beautiful area. When I traveled around, I did not realize how much I appreciated this region. This is a beautiful place to raise a family.”

New Legislation Gives New York an Edge

Matt Hurlbutt, president and CEO of Greater Rochester Enterprise (GRE), says, “Micron has already had a significant impact on Genesee County with Edwards Vacuum announcing a big project here. Micron will build out a semiconductor supply chain throughout New York.”

Hurlbutt cites an abundance of freshwater, wide experience in materials science, clean energy, and the area’s hydrogen ecosystem as factors driving the chips sector in Upstate New York. These location factors, combined with a deep and talent labor pool, propelled the nine-county Greater Rochester region to a record year in economic development performance in 2022, with $1.2 billion in capital projects announced creating 3,866 new jobs.

“New York passed the Green Chips program which helped us land Micron,” says Hurlbutt. “New York also passed a site readiness program that helps our region.”

To be eligible for Green Chips assistance, a project in New York must create at least 500 new net jobs and make at least $3 billion in investment during each 10-year project term. Qualifying companies are eligible to receive investment tax credits of up to 5% of project capital expenditures; a tax credit of up to 8% of R&D expenditures; salary and wage tax credits of up to 7.5% of payroll expenses; and real property tax credits and PILOTs (Payment in Lieu of Taxes) tax credits for 10 years.

Advanced Manufacturing projects in Greater Rochester in 2022

| Company | Invest $ | New Jobs | Retained Jobs |

|---|---|---|---|

| Baldwin Richardson | $50M | 60 | 364 |

| Corning Advanced Optics | $139M | 270 | |

| Edwards Vacuum | $319M | 600 | |

| Ionomr Innovations | $2.7M | 51 | |

| Kodak Light Blocking Materials | $38M | 123 | 17 |

| La Fermière | $25.8M | 135 | |

| Li-Cycle | $358M | 170 | |

| Ocean Insight | $1.7M | 100 | 17 |

| Optimax Systems | $20M | 50 | 355 |

| Simcona Electronics | $1.8M | 56 | 57 |

| Sydor Optics | $7.4M | 10 | 95 |

| Toptica Photonics | $7.6M | 70 | 40 |

| Vuzix | $21M | 66 | 94 |