Since the late 1980s, the global corporate facility projects database maintained and populated by Conway Data has tracked project locations and expansions by companies of every stripe in every U.S. state. But only within the past decade did we add to our columns of data a category tracking investing companies by country of ultimate beneficial owner.

Now that a critical mass of projects has been tracked, this fall we analyzed the 1,686 U.S. projects we’ve tracked since 2015 that have had at least a share of involvement by a foreign-based firm (i.e. joint ventures count). The Top 10s below represent the highest-ranking states and metros based on an index that awards points according to the territories’ ranking by number of projects involving foreign-based corporate end-user investors, total project-related capex and total project-related job creation.

The projects themselves display the power of FDI attraction for any territory’s economic development playbook.

In No. 1 Texas, they include an 80-job investment in Austin from Sweden’s Ericsson in 2018, followed up by a $3.9 million expansion this year. India’s Tata Consultancy Services (TCS) and Infosys both have also invested in the Austin area this year, with the TCS project bringing 400 jobs. The same company expanded by more than 200 positions in Plano, a DFW suburb, in 2018. Well, actually, they just welcomed them into the TCS fold from Transamerica, as part of an agreement with Transamerica to transform the administration of its U.S. insurance and annuity business lines. TCS in fact is simply occupying several floors of the Transamerica building, and described the new employees as “part of TCS recruiting and protecting more than 2,200 Transamerica jobs across the U.S. in multiple locations.”

Detroit Friendly to FDI

Those who remember the animosity domestic automakers, their leaders and their employees harbored toward foreign automakers four decades ago will find no slight irony in the fact that our project tallies show the Detroit metro area leading the way in FDI projects over the past five years. That’s due, of course, to that very automotive industry, led by Fiat Chrysler Automobiles, the Italian-American company domiciled in Amsterdam with fiscal headquarters in London and the largest voting stake held by Italian investment group Exor. Next year its merger with France’s PSA Group will close and the overall company will carry a new corporate name announced in July: Stellantis.

Among the FCA investments were projects pursued last year in Detroit, Warren and Sterling Heights. Other foreign automotive investments have come from India’s Mahindra and Mahindra in Auburn Hills; Israel’s Arbe Robotics with a $600 million investment in Detroit; French firm Faurecia’s project in Highland Park; and Nissan R&D and Guangzhou Automobile Group projects (from Japan and China, respectively) in Farmington Hills.

The Detroit area also has seen investment from Tata Group, in the form of a North American HQ for its Tata Technologies Ltd. business. “North America is a very important market for Tata Technologies,” said Tata Technologies CEO Warren Harris when the project was announced in 2018.

Quiet Giant

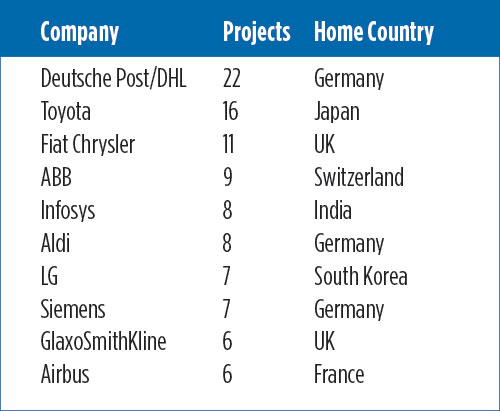

Following the thread of select foreign companies can be illuminating in terms of both economic and community impact. Among the 1,686 projects we tracked, the most frequent corporate names to pop up over the past five years are the top 10 below.

While the automotive conglomerates make the most headline noise and generally invest the most into physical plants, services firms such as Tata Group’s TCS have a hefty FDI impact all their own, even when they only have a handful of facility projects.

As recently as that Plano expansion, TCS employed more than 3,500 in Texas, including two other offices in Dallas and Houston. TCS also added Plano to its goIT education programs already up and running in San Antonio, Dallas, Houston, and Austin with the aim to inspire young people from underserved parts of the community to pursue diverse technology careers. Nationally, the company’s Ignite My Future in School (IMFIS) aims to reach 20,000 educators and 1 million students over a five-year period, and so far has reached almost 12,000 teachers and 675,000 students.

As of two years ago, TCS already had invested nearly $3 billion in the U.S. over the previous three years and was among the top two IT services job creators in the U.S.

“TCS has been among the top two U.S. recruiters of IT services talent, hiring more than 21,500 employees in the past five years alone,” the company stated in October when it was recognized for its superlative brand. “With technology emerging as central to U.S. enterprises’ ability to respond and recover from the pandemic, TCS has seen a surge in demand for its services. To support this growth, it expects to recruit an additional 10,000 individuals in the U.S. by 2022.”

UK Investment Keeps Arriving

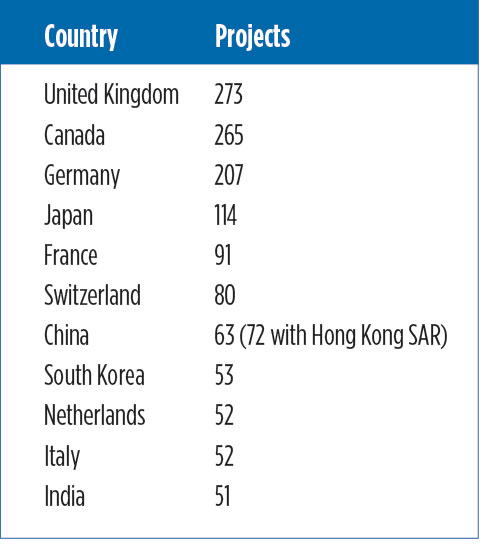

Which countries lead all comers in terms of corporate facility investments? The top 10 are found on the facing page.

These findings align with the latest insights from the U.S. Bureau of Economic Analysis (BEA) in July, which reported that new FDI in 2019 totaled $194.7 billion, down 37.7% from $312.5 billion in 2018. By country of ultimate beneficial owner (UBO), the largest investing country was the United Kingdom, with expenditures of $40.4 billion. Canada ($35.7 billion) was the second largest investing country, followed by Germany ($21.6 billion) and Japan ($17.8 billion).

Some of that UK capital arrived in October in the form of London-based global electric vehicle company Arrival, which will establish its first U.S. “Microfactory” in Rock Hill, South Carolina, with a $46 million investment and the creation of 240 new jobs. The site will utilize a new cell-based assembly method to produce vehicles rather than a traditional production line, allowing the production of any vehicle from Arrival’s portfolio.

Earlier this year, the company announced its Microfactory concept and its intent to open multiple such facilities. I asked a company spokesperson how many were in the works, and where they would go.

‘We do not have set plans on how many Microfactories we plan to build,” said Arrival spokesperson OT Airewele. “The Microfactory model is built to be adaptive and responsive to both Arrival’s needs and customer demand, so we do not put a cap or limit on the number. However, in addition to the South Carolina location, we currently have a site in Bicester, UK, and are exploring additional locations in the U.S.”