Mexico has been a growing leader in the automotive manufacturing industry for decades with companies from Japan, the U.S. and Germany frequently seeking out the low-cost yet highly capable workforce. In 2012 the country ranked as the 10th largest automotive producer in the world and in 2021 pushed out South Korea and claimed sixth place. But the Mexican National Institute of Statistics and Geography reported that in 2021 automotive production dropped by 20.25% across the country, and auto exports fell by 16.46%. The institute further reported that GM and Nissan were hit hard, with GM Mexico’s production falling by 43.7% in 2021, and Nissan Mexicana’s tumbling by 27.2%. Production halts occurred at three Nissan plants as raw materials and microchips became inaccessible.

Supply chain disintegration, the semiconductor shortage and halts in production are all effects of an industrial “long COVID.” But even after a dismal 2021, this May Nissan announced plans to invest $700 million over the next three years in its Mexican plants, including its facility in Aguascalientes.

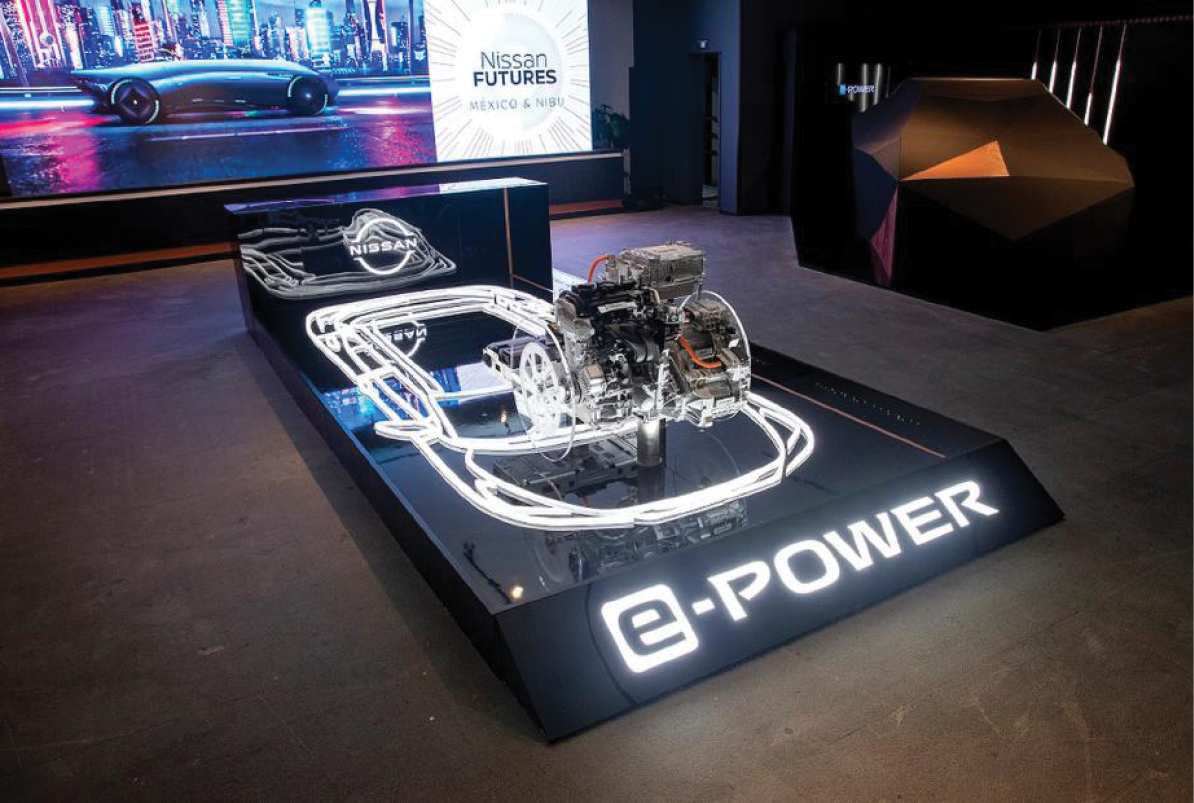

“Mexico plays an important role in Nissan’s global operations, both as one of the main markets for vehicle sales, and as an export hub for dozens of markets around the world,” said Jeremie Papin, chairperson of Nissan Americas. The company still has faith in the region, and will introduce new Nissan electric vehicles such as the Nissan Kicks e-POWER to the Mexican market.

More Lover Than Competitor

Although Mexico is producing fewer and fewer whole automobiles, the country is spectacular at producing automotive parts. “Despite the fact that fewer cars are being produced, in Mexico, we are making more for each car produced in our country,” said Manuel Montoya for Mexico Business News. Montoya is the president of the National Network of Automotive Industry Clusters, a non-profit that aims to promote automotive manufacturing in Mexico. “Thus, 2022 will be a year of growth for the Mexican automotive industry.”

Conway Data, the parent company of Site Selection magazine, has logged 90 automotive production facility projects in Mexico since the beginning of 2021, 64% of which are in parts manufacturing. This paints a tempting portrait for the Mexican auto parts industry, which grew by 21% in 2021.

The whole world seems to agree. Of these 90 projects — which include facility expansions, developments, and headquarters, — 61 are international, with the main players being the United States and Germany, who account for 37% of investment. Manufacturing represents 45% of all Mexican foreign direct investment, with the automotive industry as torch bearer.

The U.S. Bureau of Economic Analysis reports U.S. investment totaled $9.3 billion in Mexico in 2021, with transportation equipment accounting for $981 million of that total. The countries are more co-conspirators than actual competitors, since investment and nearshoring in Mexico has huge benefits for the United States, and Mexico is a consumer of U.S. goods. In 2021 the Census Bureau found that the U.S. imported $385 billion in goods from Mexico, second only to China. The U.S. also exported $276 billion to Mexico, second to Canada, which recently unseated its USMCA trade partner.

Electrifying Mexico

Analysts for The New York Times predict that by 2035 EVs will make up 25% of all new car sales and account for 60% of new sales by 2050. Demand for EVs is soaring, and buyers often have to put down deposits months ahead of time or risk the model selling out. Automotive companies are likewise putting down deposits on Mexico’s EV future.

In 2018, Mexican electric car company Zacua started production in Puebla. The company’s two models resemble muscled Mini Coopers with a range of around 100 miles per charge, perfect for urban areas. After a COVID-induced hiatus the company began selling its first cars this year for a little more than US$30,000, though subsidies upwards of $2,000 are offered. The cars are majority Mexican made, but some parts are outsourced to Spanish and French brands. Zacua CEO Nazareth Black wants this to change.

“When we started, we brought in the transmission systems from outside. Now, we make them at the plant,” she said in an interview with Diálogo Chino in June. “We want all the parts to be Mexican. That is what we have been doing over the years: working on supply issues.” Black said it can be difficult to compete with huge brands that have been coming to Mexico, realizing it’s cheap to assemble there. “Everything is more expensive for us than a global brand. If I buy 50 steering wheels, for example, Ford buys 5 million. Who will get it cheaper?”

The company is small, and vehicles are assembled by hand. Black wants to make the company attractive to foreign investors who want to use Mexico to enter North American markets, “So why don’t we make a platform to serve them? Either we see them as competition, or we collaborate and capitalize on this.”

The electric engine of Nissan’s Kicks e-POWER.

Courtesy of Nissan

In 2021 GM announced a $1 billion investment in its Ramos Arizpe plant in Coahuila, Mexico, with the intention of making it the fifth electric-specific GM plant. Initial phases will include the production of battery packs and electric motors alongside gas engines, with the potential of producing full electric vehicles in 2023, including Cadillac crossovers.

There are further rumors of Tesla considering Mexico as its next production site, possibly to be announced at the end of 2022. This speculation comes as Chinese company Contemporary Amperex Technology is said to be considering two locations in Mexico with investments up to $5 billion, possibly in the states of Chihuahua or Coahuila close to the U.S. border and to Tesla’s Texas factory in metro Austin. The company is the world’s biggest maker of electric batteries for cars and is a main supplier for Tesla.

The marriage in locations between the supplier and manufacturer would funnel billions in investment to northern Mexico, which already houses 52.1% of the country’s auto parts production. Coahuila, the location of GM’s 40-year-old manufacturing operation, represents 17.2% of auto parts production, Chihuahua 11.9% and Nuevo Leon 11.4%. All three regions are along the Texas border and have an experienced workforce with coveted proximity to the U.S. and Canada.